Credit unions need to stay competitive and efficient to meet the diverse lending needs of their members. This is where cloud-based lending software for credit unions comes in. By adopting these innovative solutions, credit unions can streamline their lending processes, make better credit decisions, and ultimately enhance their members’ financial well-being.

In this blog post, we will discuss the five best cloud-based lending software options for credit unions, exploring their features, benefits, and how they can empower financial institutions to lend with confidence and flexibility.

What is Cloud-Based Lending Software for Credit Unions?

Cloud-based lending software for credit unions is a digital platform hosted on remote servers, providing comprehensive tools to manage and automate the entire lending process. Unlike traditional, on-premise solutions, cloud-based software offers flexibility, scalability, and accessibility from anywhere with an internet connection. It eliminates the need for extensive hardware and IT infrastructure, making it an attractive option for credit unions of all sizes.

Benefits of Cloud-Based Lending Software for Credit Unions

Cloud-based lending software for credit unions offers numerous benefits that can revolutionize how these financial institutions lend.

- Enhanced Efficiency and Automation: Cloud-based lending software automates repetitive tasks such as loan origination, underwriting, and document management, freeing up valuable time for credit union staff to focus on higher-value activities like member service and relationship building.

- Improved Member Experience: By accelerating loan processing and providing convenient self-service options, credit unions can provide a more seamless and enjoyable digital lending experience for their members.

- Increased Scalability: As credit unions grow, cloud-based lending software can easily scale to accommodate increased demand without requiring significant investments in hardware or infrastructure.

- Enhanced Data Security: Reputable cloud providers implement robust security measures to protect sensitive member data, ensuring compliance with industry regulations and safeguarding against cyber threats.

- Real-Time Analytics and Reporting: Cloud-based solutions offer powerful analytics and reporting capabilities, providing lenders with valuable insights into loan portfolio performance, risk assessment, and member behavior, facilitating informed decision-making.

- Cost Savings: By eliminating the need for expensive hardware and maintenance, cloud-based lending software can significantly reduce operational costs for credit unions.

Key Features of Cloud-Based Lending Software

To fully leverage the benefits of cloud-based lending software, it’s crucial to understand its key features:

- Loan Origination System (LOS): This is the core of any lending software. A robust LOS automates and streamlines the entire loan origination process, from application intake to underwriting and funding.

- Underwriting and Decisioning Engines: These tools automate credit risk assessment, ensuring consistency, accuracy, and compliance with credit policies.

- Document Management: Cloud-based software securely stores and manages loan documents, facilitating seamless collaboration and easy access for authorized personnel.

- Borrower Portals: User-friendly portals allow borrowers to submit loan applications, track their progress, and communicate with lenders, enhancing transparency and engagement.

- Reporting and Analytics: Comprehensive reporting tools provide valuable data on loan performance, portfolio trends, and risk exposure, enabling data-driven decisions and strategic planning.

- Third-Party Integrations: Many cloud-based solutions seamlessly integrate with other essential systems such as core banking platforms, credit bureaus, and payment gateways, creating a unified lending ecosystem.

Featured Cloud-Based Lending Software: Jisort

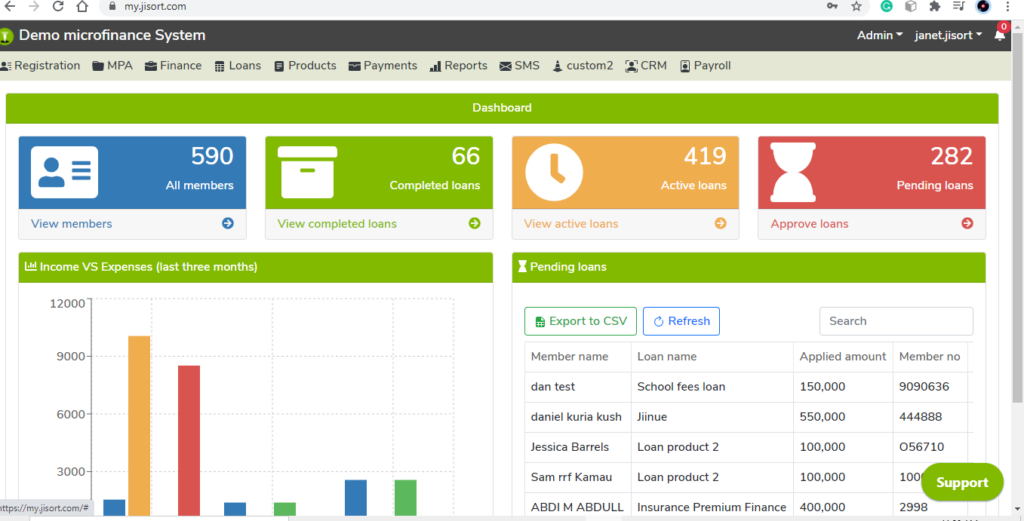

When it comes to selecting the ideal cloud-based lending software for credit unions, Jisort emerges as a clear leader. This innovative platform has been specifically designed to address the unique needs of credit unions, empowering them to streamline lending operations, enhance member experiences, and drive growth.

Why Jisort is the Best Choice for Credit Unions

Jisort boasts a comprehensive suite of features that set it apart from other cloud-based lending software solutions:

- Tailored for Credit Unions: Jisort understands the specific challenges and regulatory requirements that credit unions face. Its platform is designed to seamlessly integrate with existing systems and workflows, ensuring a smooth transition and minimal disruption.

- End-to-End Lending Solution: From loan origination to servicing and portfolio management, Jisort covers the entire lending lifecycle, eliminating the need for multiple disjointed systems. This end-to-end approach improves efficiency, reduces errors, and provides a holistic view of lending operations.

- Flexible and Configurable: Jisort’s platform is highly flexible and configurable, allowing credit unions to tailor it to their unique needs and processes. This adaptability ensures that the software aligns perfectly with the credit union’s goals and strategies.

- Robust Analytics and Reporting: Jisort provides powerful data analytics and reporting tools that empower credit unions to gain valuable insights into their lending portfolio, identify trends, and make informed decisions. This data-driven approach helps mitigate risk and optimize profitability.

- User-Friendly Interface: Jisort’s intuitive interface makes it easy for credit union staff to navigate and use the platform effectively, even without extensive technical expertise. This user-friendliness promotes adoption and maximizes the software’s value.

- Scalability: Whether your credit union is small or large, Jisort can scale to meet your needs. The platform can accommodate increasing loan volumes and expanding operations without compromising performance or efficiency.

- Seamless Integrations: Jisort integrates seamlessly with various third-party systems, such as core banking platforms, credit bureaus, and payment gateways. This integration streamlines data flow, eliminates manual data entry, and enhances overall efficiency.

- Exceptional Customer Support: Jisort provides exceptional customer support, ensuring that credit unions have the assistance they need to get the most out of the platform. Their dedicated team is readily available to address any questions or concerns.

Jisort in Action

A prominent credit union recently adopted Jisort as its cloud-based lending software and experienced significant improvements in its lending operations. The credit union was able to reduce loan processing times by 50%, increase loan approvals by 20%, and enhance member satisfaction through a more streamlined and transparent digital lending experience. This success story illustrates the transformative power of Jisort in empowering credit unions to achieve their lending goals.

Jisort stands out as the premier cloud-based lending software for credit unions, offering a comprehensive, flexible, and user-friendly solution that drives efficiency, growth, and member satisfaction. By choosing Jisort, credit unions can confidently navigate the evolving financial landscape and deliver exceptional lending services to their members.

1. Lending Cloud by Moody’s Analytics

Lending Cloud is an innovative cloud-based lending software for credit unions and banks, offering a fully integrated credit management solution. Used by over 600 financial institutions, Lending Cloud stands out for its flexibility and ease of use.

Features:

- Commercial, Agricultural, and Small Business Lending: Lending Cloud is designed to handle a range of lending scenarios, including commercial, agricultural, and small business loans.

- SaaS Delivery Model: The software-as-a-service (SaaS) model makes it easy to implement and use, with no need for costly on-premises hardware.

- Integrated Financial Spreading: Make informed credit decisions with flexible templates that allow for debt schedules and collateral analysis for all loan types.

- Robust Commercial Lending Solutions: Lending Cloud offers flexible and robust solutions to support various loan structures, pricing, and conditions, helping to reduce risk and streamline the lending process.

Benefits:

- Easy Implementation: The cloud-based nature of Lending Cloud makes it simple to adopt and use, with no complex setup processes.

- Enhanced Credit Decisioning: With integrated financial spreading and collateral analysis, credit unions can make better-informed lending decisions.

- Risk Reduction: The robust commercial lending solutions help credit unions reduce risk by accommodating various loan structures and conditions.

- Improved Efficiency: Lending Cloud streamlines the lending process, making it easier for credit unions to manage and approve loans, ultimately enhancing their operational efficiency.

2. Cloud Lending Solutions by Q2

Cloud Lending Solutions provides a secure and comprehensive cloud-based lending platform for credit unions. This software is designed to manage the entire lending cycle, from origination to collection, on a single system.

Features:

- Automation and Configuration: Cloud Lending Solutions offers automation and configuration capabilities, enabling credit unions to process more loan applications efficiently.

- Single Cloud-Based System: Manage origination, underwriting, servicing, and collection in one place, simplifying the lending process and improving efficiency.

- Automated Workflows: Eliminate manual tasks with automated workflows, allowing credit unions to focus on making more loans and serving their members better.

Benefits:

- Improved Efficiency: By automating manual tasks, credit unions can process more loan applications faster, reducing the time members spend waiting for loan decisions.

- Enhanced Digital Experience: The cloud-based nature of the software provides a secure and seamless digital experience for members, improving their overall satisfaction.

- Focus on Core Competencies: With Cloud Lending Solutions handling the lending process, credit unions can focus on their core strengths and better serve their members.

3. LendFoundry

LendFoundry is an award-winning cloud-based lending software for credit unions, offering a SaaS platform with a range of tools and accelerators for lenders. This platform is designed to manage the digital lending lifecycle efficiently and securely.

Features:

- Loan Origination and Servicing: LendFoundry provides a Loan Origination System and a Loan Servicing System, enabling credit unions to manage the entire lending process effectively.

- Additional Features: The platform includes features for customer management, compliance reporting, authentication, security, AI-powered credit scoring, and marketing.

- Cloud Technologies and Microservices: Built on cloud technologies and a microservices architecture, LendFoundry offers core lending modules and advanced features for a flexible and scalable solution.

Benefits:

- Improved Efficiency and Automation: LendFoundry’s solutions help credit unions improve efficiency and automation in lending decisions and processes, leading to faster loan approvals.

- Scalability and Flexibility: The cloud-based architecture ensures the platform is scalable and flexible, allowing credit unions to adapt to changing lending needs and market demands.

- Enhanced Data Integration: By integrating with numerous third-party data providers, LendFoundry enables credit unions to make more informed lending decisions.

4. LendKey

LendKey offers a web-based application specifically designed for credit unions and community banks. With over 15 years of industry experience, LendKey provides secure, compliant, and auditable lending software.

Features:

- Secure and Compliant: LendKey’s platform is fully secure and compliant, ensuring credit unions can easily trace origination processes, review loan files, and track performance.

- White-Label Service: LendKey offers a customized white-label service, providing consumer-facing functionality, including remittance and detailed loan-level reporting.

- Technology-Driven Solutions: LendKey specializes in providing cutting-edge, technology-driven solutions to foster growth, enhance service delivery, and optimize liquidity management for financial institutions.

Benefits:

- Peace of Mind: With secure and compliant lending processes, credit unions can have peace of mind and focus on serving their members.

- Enhanced Traceability and Transparency: The ability to easily trace origination processes, review loan files, and track performance adds transparency and helps credit unions make better lending decisions.

- Growth and Optimization: LendKey’s technology-driven solutions help credit unions foster growth and optimize their lending operations.

5. MeridianLink

MeridianLink offers a comprehensive cloud-based lending software for credit unions, providing a range of solutions to streamline the loan origination process.

Features:

- End-to-End Loan Origination: MeridianLink’s software covers the entire loan origination process, from application to decisioning, with seamless integration.

- Data Analytics: The platform includes data analytics capabilities, enabling credit unions to make informed lending decisions and improve profitability.

- Compliance and Auditing: MeridianLink ensures credit unions remain compliant with regulations, providing auditable loan origination processes.

Benefits:

- Streamlined Lending: Credit unions can efficiently manage the entire loan origination process on one platform, improving the member experience.

- Informed Decision-Making: With data analytics, credit unions can identify trends, assess creditworthiness, and make better lending decisions.

- Regulatory Compliance: MeridianLink’s software helps credit unions stay on top of evolving regulatory requirements, reducing the risk of non-compliance.

Choosing the Right Cloud-Based Lending Software for Your Credit Union

Selecting the perfect cloud-based lending software is a crucial decision for any credit union. With a plethora of options available, it’s essential to assess your specific needs and priorities to ensure the software aligns with your goals.

Define Your Objectives:

Begin by clearly outlining your objectives. Are you looking to streamline loan origination? Enhance member experiences? Improve decision-making with data analytics? Clearly defined goals will guide your selection process.

Scalability and Flexibility:

Consider the size of your credit union and its growth trajectory. Choose a platform that can scale alongside your evolving needs. The software should be flexible enough to adapt to changes in regulations, loan products, or internal processes.

Ease of Integration:

Assess the software’s compatibility with your existing systems, such as core banking platforms, credit bureaus, and payment gateways. Seamless integration is crucial for efficient data flow and a unified lending ecosystem.

User-Friendliness

The platform should be intuitive and easy to navigate for your staff. A user-friendly interface reduces the learning curve and ensures that your team can quickly adopt and utilize the software effectively.

Security Measures

Data security is paramount when dealing with sensitive member information. Prioritize software providers that employ robust security measures, such as encryption, access controls, and regular audits, to safeguard your data.

Customer Support

Reliable customer support is essential for addressing any technical issues or questions that may arise. Choose a vendor that offers responsive and knowledgeable support to ensure smooth operation and minimal downtime.

Cost-Effectiveness

Evaluate the software’s pricing model and ensure it aligns with your budget. Consider both the initial setup costs and ongoing fees. Look for a solution that delivers value for your investment and offers a favorable return on investment (ROI).

Reputation and Reviews

Research the software provider’s reputation and read reviews from other credit unions. This can provide valuable insights into the software’s performance, reliability, and customer satisfaction levels.

Demo and Trial

Request a demo or trial of the software to experience its features and functionality firsthand. This allows you to assess its suitability for your credit union’s specific needs and workflows.

Conclusion

Adopting cloud-based lending software is a crucial step for credit unions to stay competitive and meet the diverse lending needs of their members. The five software solutions discussed above—Lending Cloud, Cloud Lending Solutions, LendFoundry, LendKey, and MeridianLink—each offer unique features and benefits that empower credit unions to lend with confidence and flexibility.

By leveraging the power of cloud-based lending software, credit unions can streamline their operations, make data-driven decisions, and ultimately enhance their members’ financial well-being. With improved efficiency, enhanced decision-making capabilities, and regulatory compliance, credit unions can focus on their core mission of serving their members and communities.

As the lending landscape continues to evolve, credit unions that embrace innovation and technology will be well-positioned to thrive and meet the changing needs of their members.

Remember, when choosing cloud-based lending software, it is essential to consider your credit union’s unique needs, the features offered, and how the solution can help you better serve your members.

Read also: