Starting a business in Kenya can be exciting, but finding the right financing is often challenging.

Many entrepreneurs struggle to secure the funds they need to get their ideas off the ground or expand their operations.

Small business loans in Kenya are now more accessible than ever, with amounts ranging from Ksh 50,000 to 1 million available without collateral requirements.

These loans can provide the crucial capital you need at the early stages of your business journey.

Several financial institutions offer specialized startup financing options.

National Bank of Kenya provides Jenga Biashara loans of up to Ksh 5 million to help you expand your business, while KCB Bank offers secured short-term loans designed specifically for startups and small businesses needing quick working capital.

Some lenders like Pesapal even offer instant approval for unsecured business loans, making the financing process faster and more straightforward.

How to Access Startup Business Loans in Kenya

Kenya offers several loan options through banks, microfinance institutions, and alternative funding sources.

Types of Startup Loans

Traditional bank loans remain popular for Kenyan startups.

These loans provide larger amounts with structured repayment plans. Most banks require collateral and a solid business plan.

Online lenders offer more flexible options with faster approval times. They typically have higher interest rates but less stringent requirements.

Microfinance loans serve smaller businesses needing modest capital. These loans range from KSh 10,000 to KSh 500,000 with shorter repayment periods.

Asset financing allows you to purchase equipment while using the equipment itself as collateral. This works well for startups needing specific machinery or vehicles.

Alternative Funding Sources:

- Crowdfunding platforms

- Peer-to-peer lending networks

- Angel investors

- Venture capital firms

Each option has different terms, interest rates, and qualification requirements. Your choice should align with your business size, needs, and growth plans.

Eligibility Criteria for Borrowers

Most lenders require a well-drafted business plan showing your venture’s viability.

This demonstrates you’ve thought through your business model and revenue streams.

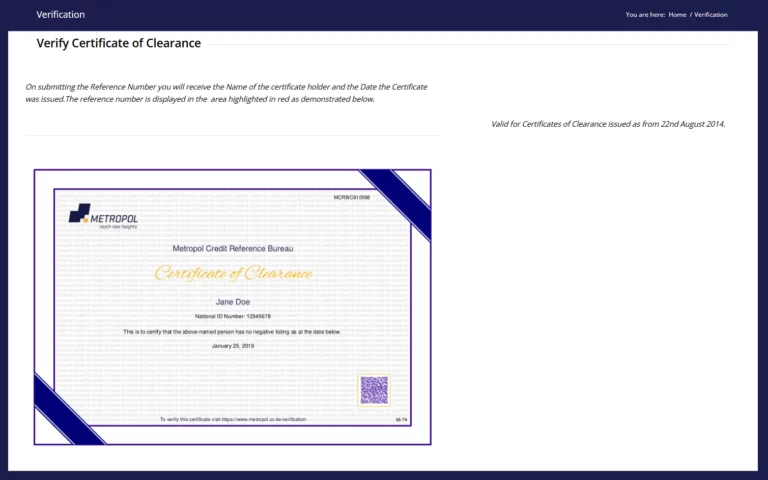

Valid business registration documentation proves your startup’s legal status.

This includes certificates of incorporation, business permits, and tax compliance certificates.

Bank statements from the past 6-12 months help lenders assess your financial management.

New businesses might need personal banking history instead.

Collateral often becomes necessary, especially for larger loans. Property, vehicles, or equipment can serve as security against the loan amount.

Credit history plays a crucial role in loan approval. Good personal credit scores improve your chances when your business lacks credit history.

Some lenders require 1-2 years of business operation before approving loans. However, certain institutions specifically target newer ventures.

The Role of Financial Institutions

Commercial banks offer structured loan products with competitive rates.

They typically have stricter requirements but provide larger amounts for established startups.

Microfinance institutions focus on smaller businesses with limited access to traditional banking. They provide crucial financing for entrepreneurs in underserved markets.

Digital lenders have revolutionized startup financing with app-based loans. These platforms use alternative credit scoring methods that consider business potential rather than just history.

That said, the rates of many digital lenders are exorbitant, and may not be worth it especially if you are looking for higher amounts.

Government institutions like Youth Enterprise Development Fund and Women Enterprise Fund offer subsidized loans to specific demographic groups.

These programs often include business training alongside financial support.

Cooperative societies provide member-based lending with favorable terms. Many entrepreneurs join cooperatives specifically to access their loan products.

Financial institutions also offer valuable business advisory services alongside loans.

This guidance helps maximize the impact of borrowed funds on your startup’s growth.

Preparing to Apply for a Startup Loan

Getting a startup loan in Kenya requires careful preparation before you submit your application.

Banks and lenders need assurance that your business is viable and you can repay the loan.

Crafting a Robust Business Plan

Your business plan is the foundation of your loan application. Lenders want to see that you’ve thought through your business concept thoroughly.

Include a clear executive summary that outlines your business idea and goals.

This should capture the essence of your business in just a few paragraphs.

Detail your market analysis showing you understand your target customers and competition. Lenders want proof that your business can succeed in the current market.

Outline your marketing strategy and operational plan. Explain how you’ll attract customers and manage day-to-day operations.

Most importantly, create detailed financial projections for at least 2-3 years. Include:

- Projected profit and loss statements

- Cash flow forecasts

- Break-even analysis

- Sales projections

Show exactly how you’ll use the loan funds and how they’ll help grow your business.

Understanding Interest Rates and Repayment Terms

Kenyan lenders offer various interest rates and repayment options for startup businesses.

Research thoroughly before applying.

Current interest rates for startup loans in Kenya typically range from 13% to 18% annually, though microfinance institutions might charge higher rates.

Repayment terms usually span from 6 months to 5 years depending on the loan amount and your business type. Shorter terms mean higher monthly payments but less interest overall.

Pay attention to additional fees that increase the total cost:

| Fee Type | Typical Range |

| Processing fee | 1-3% of loan amount |

| Insurance | 0.5-1.5% of loan amount |

| Legal fees | KSh 5,000-20,000 |

Ask potential lenders about flexibility in repayment schedules. Some offer grace periods of 1-3 months before you start making payments.

Check if there are penalties for early repayment, as some Kenyan banks charge for this.

Required Financial Documents

Lenders often require specific documentation to process your startup loan application.

Having these ready will speed up the approval process:

- Personal identification: Provide your national ID, KRA PIN certificate, and passport-sized photographs. If applying as a registered business, include your business registration certificate.

- Financial records: Prepare at least 6 months of personal and business bank statements. These show your income stability and financial management skills.

- Tax compliance: Include your tax returns for the past 1-2 years to demonstrate good standing with KRA.

Lenders also require collateral documentation for secured loans. This might include:

- Property title deeds

- Vehicle logbooks

- Fixed deposit certificates

For businesses already operating, provide financial statements showing revenue and expenses.

New startups should focus on detailed projections and personal financial history.

Most Kenyan banks require proof of a minimum of one year in business, though some microfinance institutions cater to newer ventures.

Leveraging Loans for Growth and Sustainability

Small business loans provide Kenyan entrepreneurs with the capital needed to expand operations and achieve sustainable growth.

When used strategically, these financial tools can transform businesses while promoting environmental and social responsibility.

Investment in Key Sectors

Kenyan businesses can leverage loans effectively by targeting investments in high-growth sectors.

Agriculture, technology, health, and education represent prime opportunities for sustainable business development in Kenya.

In agriculture, loans can fund modern irrigation systems, quality seeds, and equipment that increase crop yields while using fewer resources.

Many lenders now offer specialized agricultural financing with repayment terms aligned to harvest seasons.

The technology sector presents another strategic investment opportunity. Loans directed toward digital infrastructure, software development, and tech training create businesses that can scale rapidly with minimal physical resources.

Health and education ventures benefit from targeted loan investments too. Capital for medical equipment or educational facilities meets critical community needs while establishing sustainable business models in essential service sectors.

Innovation and Employment

Directing loan capital toward innovation creates a powerful multiplier effect for Kenyan SMEs.

Business loans support scaling efforts by funding research, product development, and market expansion initiatives that drive growth.

When you invest loan funds in innovative processes, you can:

- Reduce operational costs

- Create new revenue streams

- Develop competitive advantages

- Establish market leadership

Employment generation remains a key benefit of strategic loan utilization.

Expanding operations typically requires additional staff, creating jobs that strengthen local economies. This positive impact extends beyond your business to improve community stability.

Innovative funding approaches like Dumisha Loans offer flexible repayment plans designed to align with business cash flows, making it easier to manage growth while maintaining financial stability.

Balancing Loan Use with Self-Financing

Smart entrepreneurs know that external financing works best when balanced with internal resources.

Creating a mix of loan capital and self-financing provides stability during growth phases.

Effective self-financing strategies:

- Reinvesting profits systematically

- Building dedicated savings accounts for expansion

- Establishing emergency funds to handle unexpected setbacks

- Using insurance to mitigate operational risks

You can maximize loan effectiveness by clearly separating expansion capital from operational expenses.

This separation ensures loan funds directly contribute to growth rather than covering day-to-day costs that should be managed through regular revenue.

Sustainability-linked loans offer an innovative approach that aligns financing with environmental goals.

These loans provide incentives when you achieve pre-agreed sustainability targets, reducing costs while promoting responsible business practices.

Maintaining strong financial discipline ensures you can service debt obligations while continuing to build internal capital reserves for future growth phases.