Loans? Are you wondering how to get online loan in Kenya? Well, today you are in luck because we will talk more about this.

Money, there is a Swahili saying that goes” Kukopa harusi kulipa matanga”, loosely translated as borrowing money is like a wedding paying back is like a mourning period; loan lenders run into inconveniences because people apply for loans but when it comes to paying its a different story.

Many money lenders have faced the problem of people refusing to pay their loans or pretending not to have taken a loan.

How to Get Zenka Loan in Kenya

Let’s take Zenka as a loan platform:

Zenka is a loan application that allows customers to borrow money and pay it back at a given time.

Besides being a loan app they have an affiliate program that allows users to earn through advertising the Zenka App. You can earn as from Kshs 300 as per invitee so long as the invitee has borrowed a loan and paid it back.

First, you need to have a Zenka App. Go download it from either the Zenka website or Playstore.

Now that you have the App what next:

- Register your personal information, (must have an active Safaricom Line and National Identification Card.)

- Log in and go to the loan application

- Pick the loan amount and select get a loan.

- Wait for M-Pesa’s confirmation.

Zenka first-time users can apply from as little as Kshs. 500 – 30,000. Also, they offer a 61 days payment option with two payment installment options.

Loan costs are calculated based on the loan period and requested amount. The commission fee starts from 5% and the final cost of the loan will be presented when applying.

With a commission fee of 7.5% Zenka allows you to extend the due date and also borrow an extra additional amount.

Zenka app contacs in Kenya

In case of any inquiries:

- Visit Zenka Website: https://zenka.co.ke/

- Contact them on: Phone: +254 (0) 207650878, E-mail: [email protected], Facebook.

Now that you have an idea of how to get an online loan in Kenya, let’s dig in and learn about how to manage your loans.

What you need to know about loans in Kenya

Loan creditors are happy, consider this saying “Interest on debts grows without rain”, what this means is creditors make money out of lending money. How do they make money? Well if you borrow like Kshs. 2,000 and the lender have 16% Interest :

Kshs. 2,000+(2,000 x 16/100)

= Kshs. 2,320.

Now let’s say you also had a late payment and they have a penalty of 2% :

Kshs. 2,000+(2,000 x 16/100)+(2,000×2/100)

=Kshs. 2,360

Well, from the above simple calculations you also can be making extra cash out of your loans. Here is how to:

How to make money with loans in Kenya

Introducing Jisort, it’s a credit management software for Banks, Microfinance Institutions, SACCOs, Cooperatives, Credit Unions, Lending Organizations, and other MFIs.

Being up and running for 6 years it has come to help creditors with keeping records about clients and their loans. Besides Jisort is fully integrated with:

- Banks

- Mpesa

- PesaLink

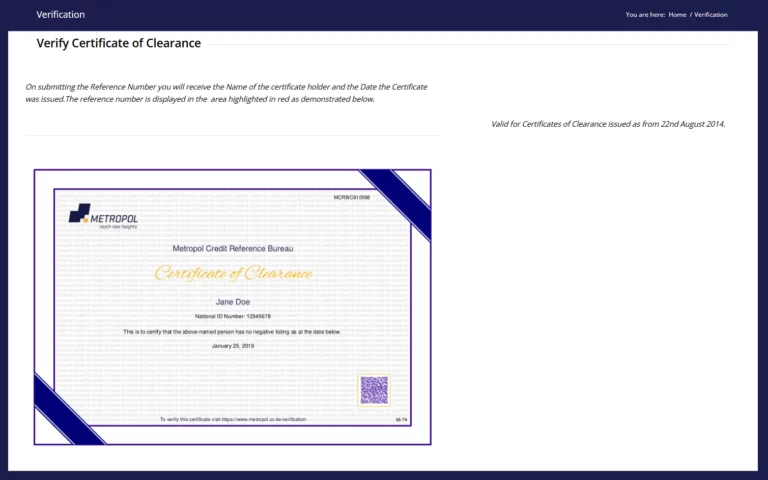

- Credit Reference Bureaus (CRBs)

- Vodacom

- Tigo

- Among others

Everyone’s goal is to make extra cash from the much they are getting, Loan lending services is a risk but with risks comes great rewards. Besides, Jisort helps you keep records on all transactions so no one can claim they didn’t apply for the loan.

The above is a demo of the Jisort system, it’s simplified and easy to use, besides you can see the relationship between income and expenses.

Lending to friends

You can issue loans easily at the touch of a button.

You get notified when the applicant is done applying for the loan and whether the process was successful.

Jisort is a simple system that has been developed to help everyone manage their credit infrastructure.

Jisort doesn’t only manage the credit infrastructure but also provides cheap and bulky SMS services.

Jisort also allows one to lend money to a friend through M-Pesa and keeps those records, besides it keeps reminding your friend of the debt until they pay you. Once they pay through Jisort you receive your money instantly.

For those considering getting into Jisort here is the link.

Don’t be afraid to get into money lending, besides, with software like Jisort you get to manage your client’s records and keep you updated on all transactions done. No one can say that they don’t remember acquiring the loan.

Take the risk and harvest big returns with Jisort.

And that is how to get an online loan in Kenya.