The lending industry is undergoing a significant transformation as lenders increasingly adopt AI-powered loan origination software to streamline their loan origination processes. AI-powered loan origination software for lenders offers a range of benefits, including faster loan approvals, improved accuracy in credit decisioning, and enhanced borrower experiences.

In this blog post, we will discuss seven of the leading AI-powered loan origination software solutions that are helping lenders revolutionize the way they lend. From automated underwriting to advanced analytics, these platforms are leveraging the power of AI to drive efficiency, profitability, and better credit risk management.

“AI-powered loan origination software for lenders” is a highly sought-after technology, and with good reason. AI can automate and streamline the loan origination process, making lending faster, more efficient, and more accurate. This not only benefits lenders through improved origination and lower costs but also enhances the borrower experience through faster loan decisions and a more seamless lending journey.

By adopting AI-powered loan origination systems, lenders can stay ahead of the competition, better manage risk, and ultimately lend more while improving their bottom line. So, let’s explore the top seven AI-powered loan origination software solutions that are shaping the future of lending.

1. Turnkey Lender: AI-Powered Loan Origination System

Turnkey Lender is a leading provider of end-to-end loan origination software that leverages the power of AI and automation. The platform offers a highly configurable loan origination system that can be tailored to the unique needs of lenders, including banks, credit unions, and alternative lenders.

With Turnkey Lender, lenders can automate the entire loan origination process, from loan application to decisioning and funding. The system utilizes AI and machine learning to underwrite loans, assess credit risk, and make data-driven loan decisions. This results in faster loan approvals, improved accuracy, and enhanced borrower satisfaction.

Turnkey Lender’s AI-powered credit decisioning engine analyzes traditional and alternative data points to make more informed credit decisions. The system can be configured with custom rules and scoring models, allowing lenders to fine-tune their underwriting criteria and optimize their loan portfolios.

One of the key strengths of Turnkey Lender lies in its flexibility and ease of integration. The platform can be seamlessly integrated with existing systems and data sources, ensuring a smooth implementation process. Additionally, Turnkey Lender offers a range of turnkey solutions for specific lending verticals, including consumer lending, small business lending, and mortgage lending.

2. Zest AI: Revolutionizing Credit Decisioning with AI

Zest AI is a leading provider of AI-powered credit decisioning software, helping lenders make more informed and accurate loan decisions. The company’s mission is to expand credit access and improve fairness in lending by leveraging the power of machine learning and artificial intelligence.

Zest AI’s software solutions enable lenders to underwrite loans more efficiently and effectively. By analyzing a broad range of data points, including traditional and alternative credit data, Zest AI’s models can assess a borrower’s creditworthiness more comprehensively. This results in more accurate risk assessments and improved loan performance.

A key advantage of Zest AI lies in its ability to help lenders increase approval rates while maintaining strong portfolio performance. The company’s AI-driven models can identify low-risk borrowers who may have been overlooked by traditional underwriting methods. This not only enhances profitability but also helps lenders serve a wider range of borrowers.

Zest AI’s software suite includes solutions for model management, decision management, and portfolio monitoring. The company’s technology integrates seamlessly with existing lending systems, ensuring a smooth implementation process. Zest AI also provides ongoing support and expertise to help lenders maximize the benefits of their AI-powered credit decisioning models.

3. LoanPro: AI-Enhanced Loan Management Solution

LoanPro is an AI-enhanced loan management solution that helps lenders streamline their lending operations and improve the borrower experience. The platform offers a range of features, including loan origination, underwriting, servicing, and collection management.

One of the key strengths of LoanPro lies in its AI-powered automation capabilities. The platform utilizes machine learning to automate various lending processes, including loan application processing, document verification, and payment processing. This results in increased efficiency, reduced costs, and faster loan decisions.

LoanPro’s AI-driven analytics provide lenders with real-time data insights and borrower behavior predictions. This enables lenders to make more informed credit decisions and proactively manage their loan portfolios. The platform also offers a flexible configuration engine, allowing lenders to customize their lending workflows and adapt to changing market needs.

LoanPro is particularly well-suited for lenders serving small and medium-sized enterprises (SMEs). The platform offers a range of features tailored to the unique needs of SME lending, including quick loan application processes, flexible repayment options, and integrated accounting solutions.

4. LendingQB: AI-Powered Mortgage Lending Platform

LendingQB is an innovative AI-powered mortgage lending platform that is transforming the way lenders originate and underwrite mortgage loans. The platform offers a comprehensive suite of features, including loan origination, underwriting, pricing, and closing.

A key differentiator of LendingQB is its AI-driven decision engine, which analyzes borrower data and documents to make instant loan eligibility decisions. The platform utilizes machine learning algorithms to automate the review and analysis of income, asset, and employment information, resulting in faster and more accurate loan approvals.

LendingQB also excels in its seamless integration capabilities. The platform can be easily integrated with a range of third-party systems and data sources, including credit reporting agencies, appraisal management systems, and settlement service providers. This ensures a smooth and efficient loan origination process, reducing the time and effort required by lenders and borrowers alike.

LendingQB’s AI-powered mortgage lending platform is particularly well-suited for lenders seeking to modernize their loan origination processes and enhance the borrower experience. The platform offers a user-friendly interface, streamlined workflows, and real-time updates, ensuring a seamless and transparent lending journey.

5. Salesforce Financial Services Cloud: AI-Enhanced Lending Solution

Salesforce, a leading provider of CRM and cloud-based software solutions, offers an AI-enhanced lending solution as part of its Financial Services Cloud. This solution enables lenders to streamline their lending processes and deliver a more personalized borrower experience.

Salesforce’s AI-powered lending solution provides lenders with a 360-degree view of the borrower, aggregating data from various touchpoints and systems. This enables lenders to make more informed credit decisions and offer tailored loan products and services. The platform’s AI capabilities include intelligent lead scoring, automated document processing, and predictive analytics for loan portfolio management.

One of the key strengths of Salesforce’s lending solution lies in its seamless integration with other Salesforce products and services. Lenders can leverage the power of Salesforce’s CRM, sales, and marketing capabilities to enhance borrower engagement and build long-lasting relationships. The platform also offers a high degree of customization and configurability, allowing lenders to adapt the solution to their unique needs and workflows.

Salesforce’s AI-enhanced lending solution is particularly well-suited for lenders seeking to modernize their technology stack and deliver a more connected and personalized borrower journey. The platform enables lenders to streamline processes, automate tasks, and make data-driven decisions, resulting in improved efficiency and enhanced borrower satisfaction.

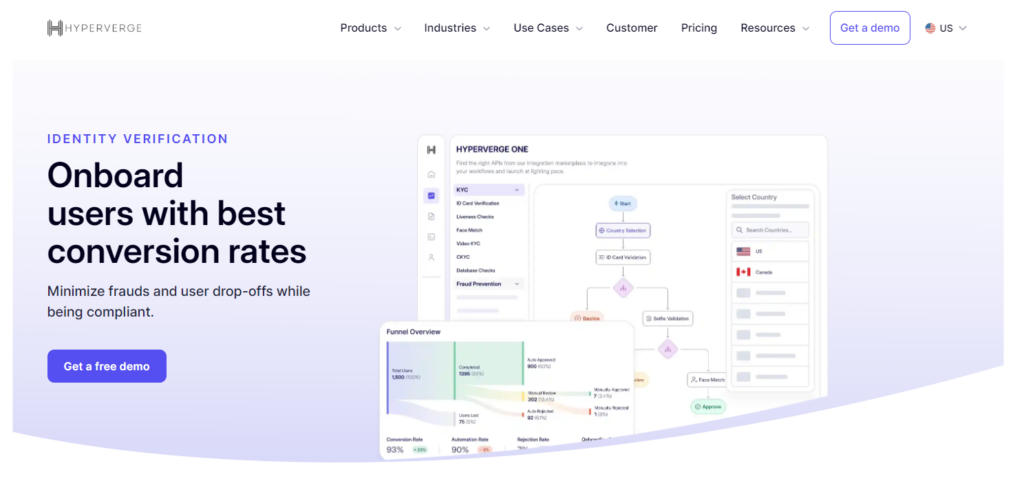

6. HyperVerge’s Loan Origination Software

HyperVerge’s loan origination software harnesses the power of AI for intelligent loan origination, aiding lenders in streamlining their processes and making data-centric decisions.

It focuses on features like identity verification, risk assessment and management, simplified underwriting, and accurate reporting and analytics to enhance the lending experience.

7. Ellie Mae’s Encompass AI: AI-Enhanced Mortgage Origination

Ellie Mae, a leading provider of mortgage lending software, has enhanced its Encompass loan origination system with AI capabilities. Encompass AI is designed to streamline the mortgage origination process, improve efficiency, and enhance the borrower experience.

A key feature of Encompass AI is its automated data extraction and document processing capabilities. The platform utilizes machine learning to quickly and accurately extract data from loan application forms, income documents, and asset statements. This reduces manual data entry, resulting in faster loan approvals and improved accuracy.

Encompass AI also includes AI-powered compliance checks and eligibility assessments. The platform automatically verifies borrower information against lending guidelines and regulatory requirements, ensuring compliance throughout the mortgage origination process. Additionally, Encompass AI provides lenders with real-time insights and recommendations, helping them make data-driven decisions and optimize their loan portfolios.

Encompass AI is particularly well-suited for mortgage lenders seeking to automate and streamline their loan origination processes. The platform enables lenders to reduce manual tasks, improve efficiency, and deliver a seamless and transparent borrowing experience. With Encompass AI, lenders can make faster, more informed credit decisions while ensuring compliance at every step.

AI-Powered Loan Origination Software for Lenders: The Way Forward

The lending industry is undergoing a significant transformation, and AI-powered loan origination software for lenders is at the heart of this evolution. By leveraging the power of AI, lenders can automate and streamline their loan origination processes, resulting in faster loan decisions, improved accuracy, and enhanced borrower experiences.

The seven AI-powered loan origination software solutions featured in this blog post are leading the way in terms of innovation and impact. From automated underwriting to advanced analytics, these platforms are helping lenders revolutionize the way they lend.

As AI continues to shape the lending landscape, lenders who embrace this technology will be well-positioned to stay ahead of the competition. AI-powered loan origination software for lenders offers a range of benefits, including improved origination efficiency, enhanced credit risk management, and increased profitability.

To stay competitive in the lending market, lenders should evaluate and adopt AI-powered loan origination software that aligns with their unique needs and goals. By doing so, they can transform their lending operations, enhance the borrower journey, and drive long-term success.

Contact our sales team to learn more about how AI-powered loan origination software can revolutionize your lending business.

With the power of AI, lenders can look forward to a future of faster, more efficient, and data-driven lending, ultimately improving the overall lending experience for all stakeholders involved.

Read also: