P2P lending, or peer-to-peer lending, is a type of direct lending that matches borrowers with lenders through an online lending platform. It eliminates the need for traditional intermediaries such as banks, creating a more efficient and cost-effective lending process. The rise of P2P lending has led to the development of specialized lending software that facilitates these transactions and provides a seamless experience for both borrowers and lenders. This blog post will discuss the best lending business software for peer-to-peer lending, outlining their features and benefits.

When it comes to the best lending business software for peer-to-peer lending, there are several options available in the market. Peer-to-peer lending, also known as P2P lending, has gained popularity as an alternative financing option for borrowers and investors alike. It involves individuals lending money to each other without going through traditional financial institutions like banks. This model has disrupted the lending industry by providing faster, more accessible, and often more affordable loan options.

The success of P2P lending relies heavily on robust lending software that can facilitate secure and efficient transactions between peers. This software enables individuals to lend and borrow money directly from each other, cutting out the middleman and resulting in lower interest rates and fees. As the demand for P2P lending continues to grow, the need for reliable and feature-rich lending software becomes increasingly important.

In this blog post, we will discuss the six best lending business software for peer-to-peer lending. Each of these platforms offers a range of features and benefits that cater to the unique needs of P2P lending, including borrower and lender matching, loan management, payment processing, and more. So, whether you are an individual looking to invest in P2P loans or a business seeking to offer P2P lending services, read on to discover the top lending software solutions in the market today.

What is a Lending Platform?

A lending platform, also known as a P2P lending platform or a peer-to-peer lending marketplace, is an online service that connects borrowers and lenders directly. It acts as an intermediary, facilitating the lending process and ensuring a smooth and secure experience for all parties involved. Lending platforms typically provide a range of features such as borrower and lender registration, loan application and approval processes, payment processing, and loan management tools.

Why Use Lending Software for P2P Lending?

Using specialized lending software for P2P lending offers several advantages over traditional lending methods:

- Efficiency and Convenience: Lending software automates the lending process, making it faster and more convenient for both borrowers and lenders. Borrowers can apply for loans online, and lenders can easily review and approve loan applications with a few clicks.

- Lower Costs: By cutting out intermediaries, P2P lending platforms reduce the overall cost of borrowing and lending. This results in lower interest rates and fees for borrowers and higher returns for lenders.

- Access to Capital: P2P lending platforms provide borrowers with access to a wider pool of lenders, increasing their chances of obtaining the funds they need. Similarly, lenders can diversify their investment portfolios by lending to multiple borrowers.

- Credit Assessment: Lending software often incorporates credit assessment tools that analyze borrower creditworthiness. This helps lenders make informed decisions and manage their risk effectively.

- Secure and Transparent: Reputable lending platforms prioritize security and transparency. They employ encryption technologies and secure payment processing methods to protect user data and funds.

- User-Friendly Interface: A well-designed lending platform offers a user-friendly interface that makes it easy for borrowers and lenders to navigate the lending process, ensuring a positive user experience.

The 6 Best Lending Business Software for Peer-to-Peer Lending

Now that we’ve discussed the benefits of using lending software for P2P lending, let’s explore the top six options available in the market today:

1. Upstart

Upstart is a leading AI-powered lending platform that utilizes machine learning to improve access to affordable credit for borrowers. The platform was founded in 2012 by a team of former Google employees and has since originated over $17 billion in loans. Upstart’s lending software uses artificial intelligence to analyze thousands of data points beyond the traditional FICO score, resulting in more accurate credit decisions.

Key Features:

- AI-powered credit decisions: Upstart’s machine learning models assess borrower creditworthiness based on education, employment history, and other factors, resulting in more accurate loan approvals.

- Automated borrower verification: The platform automates the borrower verification process, including identity verification and income validation, making it more efficient and secure.

- Customized loan options: Upstart offers a range of loan products, including personal loans, auto loans, and student loans, with flexible terms and competitive interest rates.

- Real-time fraud detection: Upstart’s advanced fraud detection systems identify and mitigate potential risks, ensuring a safe and secure lending environment.

- Comprehensive lender dashboard: Lenders on the platform have access to a user-friendly dashboard where they can manage their investment portfolios, view loan performance, and receive payments.

2. Prosper

Prosper is another well-known name in the P2P lending industry, having facilitated over $19 billion in loans since its inception in 2005. The platform connects individuals seeking loans with investors looking for solid investment opportunities. Prosper offers a transparent and secure lending environment, providing comprehensive credit profile assessments and easy-to-use investment tools.

Key Features:

- Quick and easy loan application: Prosper’s online loan application process is straightforward and efficient, allowing borrowers to apply for loans of up to $40,000 in just a few minutes.

- Comprehensive credit assessment: Prosper evaluates borrowers based on a variety of factors, including credit score, debt-to-income ratio, and employment status, to determine creditworthiness.

- Fixed-rate, fixed-term loans: Prosper offers fixed-rate, fully amortizing loans with terms of 3 or 5 years, providing borrowers with stable and predictable monthly payments.

- Automated investment tool: The Prosper Investor tool allows lenders to create custom investment portfolios, set investment criteria, and automatically invest in a diversified range of loans.

- Performance tracking: Prosper provides lenders with detailed performance tracking and reporting tools, allowing them to monitor the performance of their investments over time.

3. LendingClub

LendingClub is one of the largest and most established P2P lending platforms in the United States. Founded in 2006, LendingClub has facilitated over $70 billion in loans, making it a trusted name in the industry. The platform offers a range of loan products, including personal loans, business loans, and patient financing. LendingClub provides a secure and transparent lending environment for both borrowers and investors.

Key Features:

- Wide range of loan products: LendingClub offers a variety of loan options, including personal loans for debt consolidation, home improvement, and major purchases, as well as business loans and patient financing.

- Secure and transparent platform: LendingClub employs bank-level encryption and security measures to protect user data and funds. The platform also provides clear and transparent loan terms, ensuring borrowers and investors understand the loan details.

- Automated investment tool: LendingClub’s automated investing feature allows investors to set their investment criteria and automatically invest in a diversified portfolio of loans that match their risk and return preferences.

- Detailed credit profiles: The platform provides comprehensive credit profiles of borrowers, including credit scores, income, and employment information, helping investors make informed investment decisions.

- Robust borrower verification: LendingClub employs a rigorous borrower verification process, including identity verification and income validation, to ensure the accuracy and authenticity of borrower information.

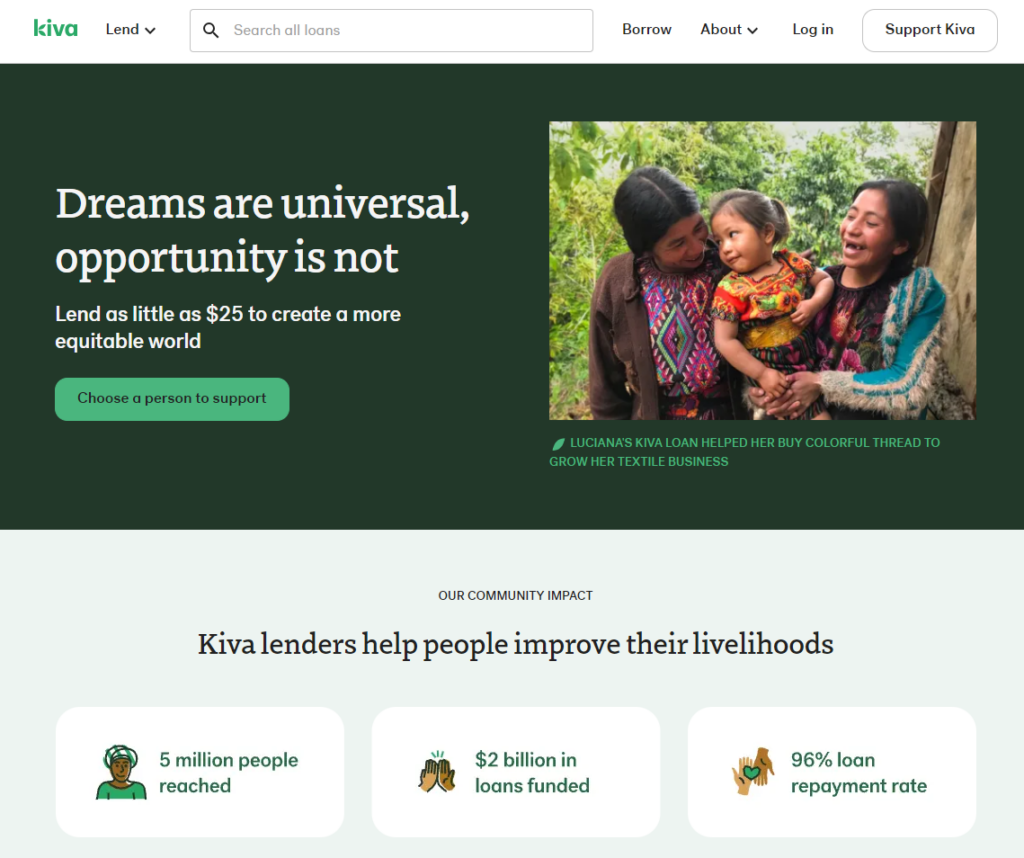

4. Kiva

Kiva is a unique P2P lending platform with a mission to expand financial access to underserved communities globally. The platform connects lenders with borrowers in over 77 countries, facilitating small business loans, student loans, and personal loans. Kiva stands out for its focus on social impact and commitment to providing financial opportunities to those who need it most.

Key Features:

- Global reach: Kiva has a presence in over 77 countries, providing lenders with diverse investment opportunities and supporting borrowers in underserved communities worldwide.

- Microfinance focus: Kiva specializes in small business loans, student loans, and personal loans with amounts ranging from $25 to $15,000, making it accessible to a wide range of borrowers.

- 0% Interest for Borrowers: Kiva does not charge any interest to borrowers, making it an attractive option for those seeking affordable loan alternatives.

- Social impact investing: Lenders on Kiva can support borrowers based on their location, gender, sector, or other criteria that align with their values and social impact goals.

- 100% repayment rate: Kiva has a perfect repayment rate, with all loans being repaid in full, thanks to its robust risk management and borrower support systems.

5. Zopa

Zopa is one of the oldest and most trusted P2P lending platforms in the United Kingdom, having launched in 2005. The platform has facilitated over £6 billion in loans and offers a range of investment products for lenders. Zopa stands out for its focus on providing a simple and transparent lending experience, with an easy-to-use platform and competitive interest rates.

Key Features:

- Competitive interest rates: Zopa offers competitive interest rates for borrowers, starting from 2.9% APR, making it an attractive alternative to traditional bank loans.

- Easy loan application process: Borrowers can apply for loans of up to £25,000 in just a few minutes, with a simple and straightforward online application process.

- Automated investment plans: Lenders can create customized investment plans based on their risk appetite and investment goals, with the option to automatically reinvest their returns.

- Comprehensive credit checks: Zopa performs comprehensive credit checks on borrowers, including soft and hard credit searches, to assess creditworthiness and determine loan eligibility.

- Secure and regulated: Zopa is authorized and regulated by the Financial Conduct Authority (FCA), ensuring a secure and compliant lending environment for users.

6. Mintos

Last but not least, we introduce Mintos. They partner with lending companies from around the world, allowing investors to diversify their investments across different countries and currencies. Investors on Mintos can spread their investments across many loans to reduce risk.

- Mintos is a P2P lending platform that is based in Latvia.

- Mintos offers investors the opportunity to invest in loans from borrowers all over the world.

- Mintos has facilitated over $8 billion in loans since its inception.

- Mintos offers investors a variety of tools to help them diversify their portfolios and maximize their returns.

Factors to Consider When Choosing Lending Software

When selecting the best lending business software for peer-to-peer lending, there are several factors to consider to ensure you choose a platform that meets your specific needs:

- Security and Compliance: Ensure the lending software you choose prioritizes security and compliance. Look for platforms that employ encryption technologies, secure data storage, and two-factor authentication to protect user information and funds.

- Loan Types and Flexibility: Consider the types of loans the platform supports and whether it aligns with your business needs. Some platforms specialize in personal loans, while others offer a wider range of loan products, including business loans, student loans, and more.

- Automation and Efficiency: Opt for lending software that automates various lending processes, such as borrower onboarding, credit assessment, loan origination, and repayment management. This will save time, reduce manual errors, and improve the overall efficiency of your lending business.

- User Experience and Interface: A user-friendly and intuitive interface is crucial for a positive user experience. Look for platforms with a smooth user journey, easy navigation, and clear call-to-actions for both borrowers and lenders.

- Credit Assessment Tools: Effective credit assessment tools are essential for managing risk and ensuring the creditworthiness of borrowers. Choose a platform that offers comprehensive credit checks, including soft and hard credit searches, and alternative data analysis for more accurate credit decisions.

- Investment Tools for Lenders: If you are targeting lenders and investors, ensure the lending software provides comprehensive investment tools. This includes automated investment plans, portfolio management, performance tracking, and the ability to set investment criteria.

- Customer Support and Service: Reliable customer support is essential for both borrowers and lenders. Choose a lending software provider that offers timely and responsive customer service to address any issues or queries that may arise.

- Integration Capabilities: Consider the integration capabilities of the lending software. The ability to integrate with other systems and platforms, such as payment processors, identity verification services, and credit bureaus, can enhance the functionality and efficiency of your lending platform.

- Scalability and Growth: Opt for a lending software solution that can scale as your business grows. This includes the ability to handle increased transaction volume, user base, and potential expansion into new markets or loan products.

- Pricing and Cost Structure: Finally, consider the pricing model and cost structure of the lending software. Some platforms charge a one-time license fee, while others offer subscription-based models or transaction-based fees. Choose a pricing model that aligns with your business needs and budget.

Choosing the Right Lending Software for Your Business

In conclusion, the rise of P2P lending has revolutionized the way individuals and businesses access credit, providing a more efficient, accessible, and affordable alternative to traditional lending. The success of P2P lending relies heavily on robust lending software that facilitates secure and seamless transactions between peers.

When it comes to choosing the best lending business software for peer-to-peer lending, the six options presented in this blog post – Upstart, Prosper, LendingClub, Kiva, Zopa, and our custom P2P lending software – offer a range of features and benefits that cater to diverse needs. From AI-powered credit decisions to social impact investing, each platform brings something unique to the table.

As the P2P lending industry continues to evolve, the demand for reliable and innovative lending software will only increase. Whether you are an individual looking to invest in P2P loans or a business seeking to offer P2P lending services, selecting the right lending software is crucial for success. Consider your specific requirements, target audience, and growth plans when making your choice.

By opting for lending software that prioritizes security, automation, user experience, and compliance, you can establish a robust and efficient lending platform that benefits both borrowers and lenders. Remember to keep an eye on emerging trends and technologies in the lending space, such as blockchain and AI, which are shaping the future of P2P lending.

We hope this blog post has provided valuable insights into the best lending business software for peer-to-peer lending. If you are interested in learning more about our custom P2P lending software solutions or have any questions, please don’t hesitate to contact us. Our team of experts is ready to help you take your lending business to the next level.

Read also:

- Compliance Requirements for Lending Software: Best Practices to Ensure Fair and Secure Lending

- Top 7 Lending Business Software with Mobile App for Borrowers

- 9 Best Loan Management Software for Mortgage Brokers

- 6 Best Affordable Lending and Accounting Software for Nonprofits

- Pros and Cons of Using Peer-to-Peer Lending Platforms for Your Business