Understanding how Pay As You Earn (PAYE) works is essential for employees and employers in Kenya.

PAYE ensures that taxes are deducted directly from salaries and remitted to the Kenya Revenue Authority (KRA).

It applies to income such as salaries, bonuses, and allowances, making it a key part of your financial planning.

So, whether you’re a business owner managing payroll or an employee checking your payslip, grasping the details of PAYE is vital.

This knowledge helps you stay compliant with tax regulations while keeping your finances in check.

What is PAYE?

Pay As You Earn (PAYE) is a tax system used to collect income tax directly from employees’ salaries. Employers are responsible for deducting this tax from an employee’s earnings and remitting it to the Kenya Revenue Authority (KRA).

It covers various forms of income, such as:

- Salaries: Your fixed monthly earnings.

- Bonuses: Extra payments for outstanding performance.

- Allowances: Perks like housing, transport, and medical benefits.

By automating tax deductions, PAYE ensures employees contribute their fair share to government services and development projects.

For businesses, integrating payroll systems can streamline this process. Jisort offers robust features to calculate taxes, manage allowances, and generate detailed reports for compliance.

How to Calculate PAYE in Kenya

Components of Gross Income

Gross income is the starting point for PAYE calculations. It includes all earnings before any deductions.

Here’s what counts as gross income:

- Basic salary: The main component of your monthly earnings.

- Allowances: Payments for housing, transport, or other needs.

- Bonuses: Rewards for exceptional work or seasonal benefits.

- Commissions: Earnings based on performance, like sales incentives.

- Non-cash benefits: Perks like a company car or free housing exceeding Ksh 3,000 per month.

Subtracting Allowable Deductions (Taxable Income Calculation)

To calculate PAYE, you first subtract allowable deductions from gross income.

These deductions reduce your taxable income, saving you money. Common deductions include:

- Pension contributions: Payments to registered retirement schemes, capped at Ksh 30,000 per month.

- Mortgage interest: Interest paid on loans for buying or improving your home.

- Disability exemptions: Special tax relief for persons with disabilities.

By managing these deductions effectively, you can lower your PAYE liability.

Employers can use cloud-based systems to track and apply these deductions consistently.

PAYE Tax Rates and Bands in Kenya

As is the case in many countries, Kenya uses a tiered tax system, meaning different portions of your income are taxed at varying rates.

Here’s a breakdown of the 2025 PAYE rates in Kenya:

| Monthly Income (Ksh) | Tax Rate (%) |

| Up to 24,000 | 10% |

| 24,001 – 32,333 | 25% |

| 32,334 – 500,000 | 30% |

| 500,001 – 800,000 | 32.5% |

| Above 800,000 | 35% |

For example, if your taxable income is Ksh 90,000:

- The first Ksh 24,000 is taxed at 10% (Ksh 2,400).

- The next Ksh 8,333 is taxed at 25% (Ksh 2,083.25).

- The remaining Ksh 57,667 is taxed at 30% (Ksh 17,300.10).

- Total PAYE = Ksh 21,783.35.

Subtracting Reliefs from PAYE

The totaltax youpay will be net of reliefs. There are two main reliefs in Kenya:

- NHIF Relief: Ksh 240

- Personal Relief: Ksh2,400

- Total relief: Ksh 2,240

Other Statutory Deductions

In addition to PAYE, your salary may include other mandatory deductions, such as:

- NSSF (National Social Security Fund): Payments of up to Ksh 1,080 per month for retirement savings.

- SHIF (Social Health Insurance Fund): Contributions are 2.75% of gross monthly income.

- Affordable Housing Levy: Both employees and employers contribute 1.5% of the gross salary.

How to Calculate Net Pay

Net pay is what remains after all deductions. The formula is:

Net Pay = Gross Income – (PAYE + SHIF + NSSF + Housing Levy)

Let’s calculate net pay for a gross salary of Ksh 100,000:

| Gross Income | 100000 |

| NSSF: | 1080 |

| TAXABLE PAY: | 98920 |

| INCOME TAX: | 24459.35 |

| NHIF RELIEF: | -255 |

| PERSONAL RELIEF: | -2400 |

| P.A.Y.E: | 21804.35 |

| PAY AFTER TAX: | 77115.65 |

| NHIF: | 1700 |

| NET PAY: | 75415.65 |

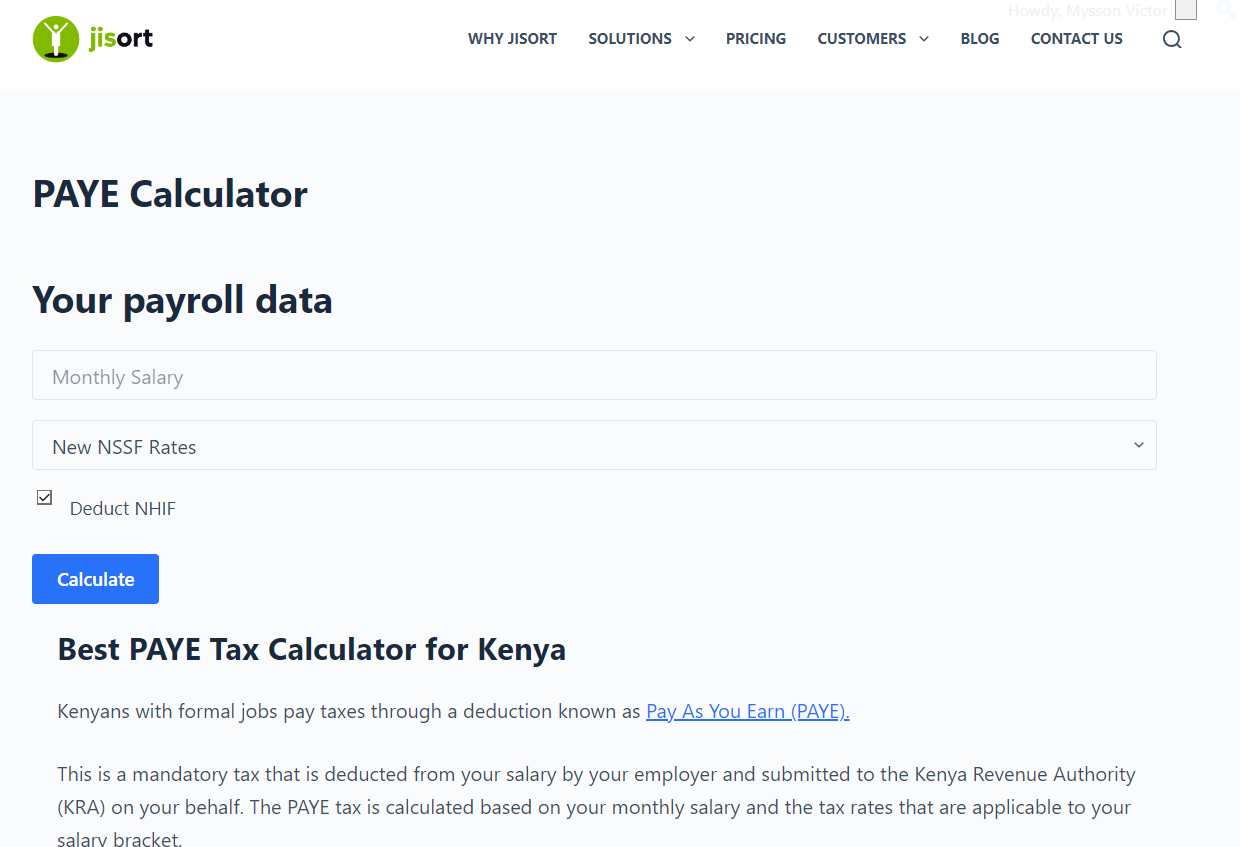

Tools for Simplifying PAYE Calculations

Accurate PAYE calculations can be time-consuming, but modern tools make it easier.

You can use our built in Jisort PAYE calculator to determine taxes, or use free online tools that are equally accurate though may not be up-to-date.

Popular PAYE Calculators to try

- Jisort Calculator

- Calculator Kenya

- KRA PAYE Calculator

- Moneyspace PAYE Calculator

- Payroll software like SME Payroll and MyWorkPay.