If you’ve ever taken a loan or bought something on credit, your financial behavior is being tracked.

In Kenya, this is done by the Credit Reference Bureaus (CRBs). These companies collect your borrowing and repayment records and give you a credit score.

Your CRB status tells lenders if you’re likely to repay your loan or not.

A positive status means you’re in good standing. A negative status means you’ve defaulted or delayed payments.

But how do you know where you stand? You don’t need to guess.

Here’s a detailed, simple guide to help you check your CRB status in Kenya — whether you’re blacklisted, good to go, or somewhere in between.

What You Need Before You Start

To check your CRB status, you only need:

- Your national ID number

- A working mobile phone (preferably Safaricom)

- Some airtime or M-Pesa balance (KES 50–100)

- Access to mobile data (optional)

Let’s break down how to do it using the three licensed CRBs in Kenya:

1) Checking via Metropol CRB

Metropol is one of the oldest and most popular CRBs in Kenya. You can check your status using a USSD code, their app, or their website.

Using USSD code (*433#)

This is the quickest method:

- Dial *433# on your Safaricom line

- Enter your National ID number

- When asked for an agent number, enter 0

- Pay KES 50 via M-Pesa to Paybill 220388, using your ID as the account number

- You’ll receive:

- A PIN

- A reference number

- A link to view your credit report

Tip: Always keep the SMS safe; it contains credentials for future logins.

Using the Metropol Crystobol app

If you prefer apps:

- Download Metropol Crystobol from the Google Play Store or Apple App Store

- Sign up with your ID number and mobile

- Pay KES 50 via M-Pesa as instructed

- Get full access to your credit score, loan history, and CRB status

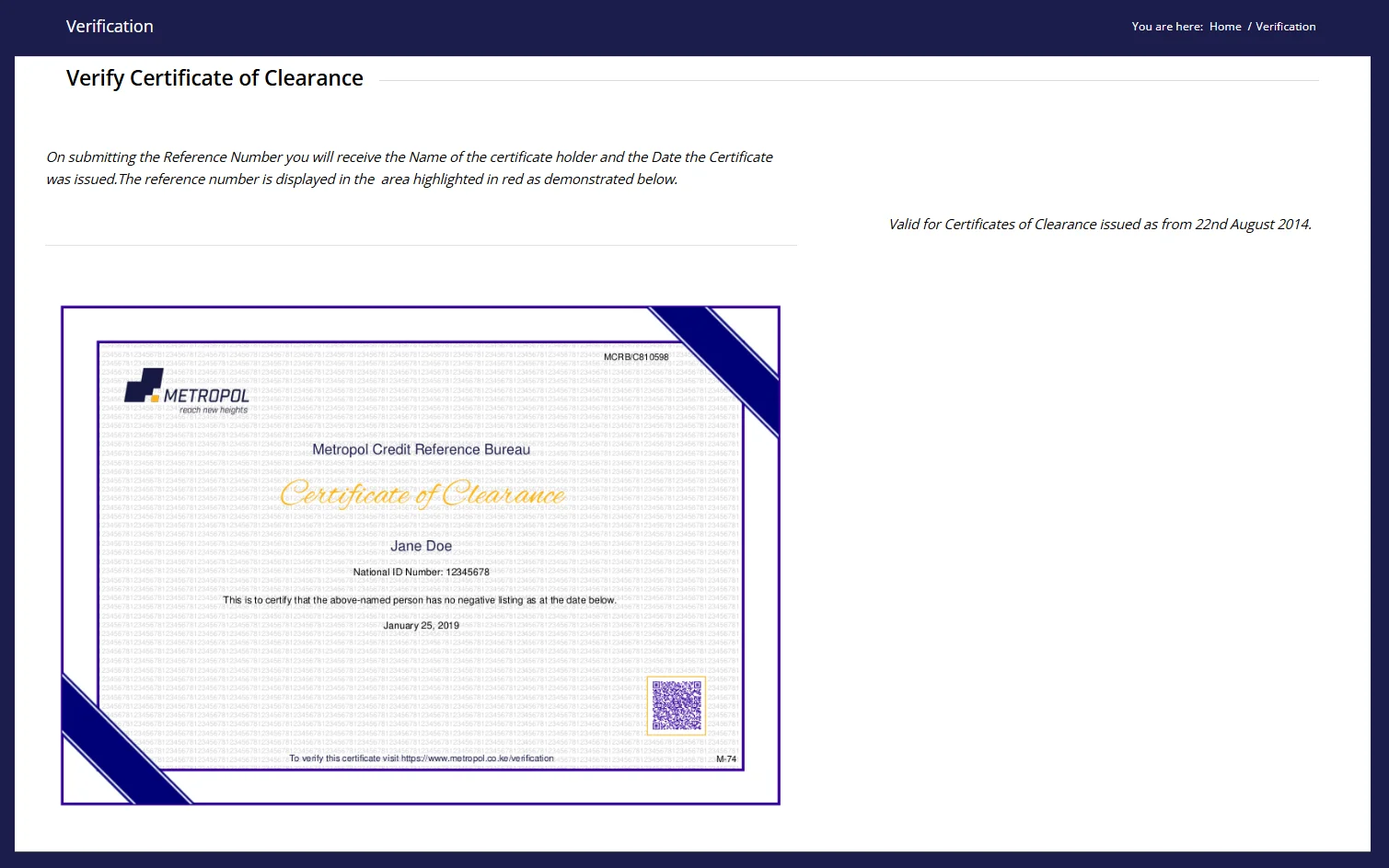

On the Metropol website

You can also register at metropol.co.ke to get your report:

- Create an account

- Use the M-Pesa Paybill 220388 to make payments

- You’ll be charged KES 650 to download your full credit report

2) Checking via TransUnion CRB

TransUnion is another reliable CRB, known for its SMS-based access and the Nipashe app.

Using SMS to 21272

This is super basic:

- Text your full name to 21272

- Enter your ID number when prompted

- Follow the steps to check your status

⚠️ This is not a full report — it’s just your status (good or bad).

Using the TransUnion Nipashe app

To access your full profile:

- Get the Nipashe app on Google Play or App Store

- Register with your ID and mobile number

- Pay KES 50 via Paybill 212121, using your ID as account number

- View your credit history, score, and current CRB standing

On the TransUnion website

Visit transunionafrica.com to sign up:

- Submit your ID and personal details

- Make the payment

- Log in to download your report or view it online

3) Checking via CreditInfo CRB

This one doesn’t use SMS or USSD. It’s completely online — ideal if you prefer email communication.

Through the CreditInfo website

- Visit creditinfo.co.ke

- Click “Request your credit report”

- Fill out a form with your:

- Full name

- ID number

- Email address

- Phone number

- You’ll get your free annual report via email within 1–2 business days

This method is ideal for people who want a formal copy of their CRB report.

Understanding Your Credit Report

When you finally get your report, here’s what you should look out for:

| Term | What it means |

| Credit score | A number (typically 0–900) that shows how risky you are to lenders. The higher, the better. |

| Negative listing | This shows that you’ve defaulted or delayed repaying a loan. |

| Positive listing | Means you’ve been paying loans on time. |

| Loan balances | The amount you owe various lenders, if any. |

| Guarantor exposure | If you guaranteed someone else’s loan, it might show here too. |

Why Your CRB Status Matters

Being blacklisted can block you from:

- Getting bank loans

- Accessing Fuliza, M-Shwari, Tala, Branch, or other digital loans

- Applying for a mortgage

- Getting hired in some sectors

Even a KES 900 loan default can haunt your record.

Checking your CRB status helps you stay ahead. You’ll know where you stand and can fix errors before they affect you.

Pro Tips to Keep Your CRB Record Clean

- Always repay loans on time. Even late payment by a few days can get listed

- Don’t borrow from many apps at once — it looks suspicious

- Check your report at least once a year (your free report is your right)

- Don’t ignore unknown M-Pesa deductions or strange loan approvals — report them immediately

Final Word

Your CRB status in Kenya isn’t just a financial number — it’s your reputation. So, whether you’re applying for a loan, buying on credit, or job hunting, people check this before they say yes.

Don’t wait for a rejection to find out your status. Dial that code, open that app, or send that SMS. It takes less than 5 minutes.

If you want more updates and money guides like this, check out MoneySpace.