M-PESA has become a vital tool for handling payments in Kenyan businesses.

However, managing payments alone isn’t enough — you also need a seamless way to keep track of your transactions, monitor cash flow, and generate reports for better financial planning.

That’s where integrating M-PESA with your accounting systems comes in.

This integration can save you time, reduce errors, and help you maintain a clear overview of your business’s financial health.

Why Integrate M-PESA with Accounting Systems?

- Automated transaction recording: No need to manually input payment details—transactions are synced directly to your accounting software.

- Improved accuracy: Minimize human errors in financial reporting.

- Better financial tracking: Monitor income, expenses, and cash flow in real-time.

- Faster reconciliation: Easily match M-PESA payments with invoices or sales records.

- Compliance and reporting: Generate detailed financial reports for taxes, audits, or investors.

Popular accounting systems compatible with M-PESA

Several accounting software options support M-PESA integration, either directly or through third-party tools:

- QuickBooks Online: Popular among small and medium-sized businesses, it offers easy integration for tracking M-PESA payments.

- Xero: A cloud-based solution that allows you to connect M-PESA payments to invoices and financial records.

- Sage: Offers advanced features for M-PESA integration, including multi-currency options for businesses with international dealings.

- Zoho Books: A cost-effective tool with customizable workflows for syncing M-PESA transactions.

- Wave: Ideal for small businesses looking for free accounting tools with basic M-PESA integration options.

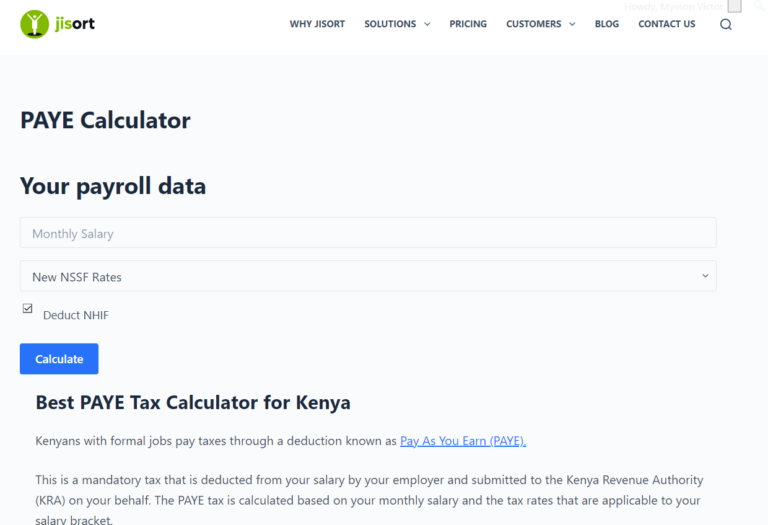

Using Jisort

For businesses seeking a user-friendly integration solution, Jisort bridges M-PESA with your accounting system. This cloud-based platform eliminates the need for extensive technical knowledge while offering real-time transaction updates.

Methods of Integration

a) Using the M-PESA API

Safaricom offers an M-PESA API (Application Programming Interface) that allows you to connect your M-PESA Business Till directly to your accounting system.

You’ll need a developer or IT expert to implement this integration.

Benefits: Real-time syncing of transactions and advanced customization.

b) Third-party tools and plugins

Tools like PesaPal and PayGo Africa bridge the gap between M-PESA and accounting systems.

They are user-friendly and often require minimal setup.

Benefits: Quick implementation without needing advanced technical skills.

c) Manual data export

You could also use the M-PESA Business App to download transaction reports and upload them to your accounting software.

Benefits: Suitable for small businesses with fewer transactions.

Steps to integrate M-PESA with your accounting system

1) Identify your needs

- Determine the volume of transactions and the level of automation you need.

- Consider the size of your business and your accounting requirements.

2) Choose the right accounting system

- Select software that aligns with your business size, complexity, and budget.

- Ensure it supports integrations with M-PESA or third-party tools.

3) Set up the integration

- Work with a developer or use ready-made plugins for quick integration.

- Test the setup to ensure transactions are recorded accurately.

4) Train your staff

- Educate your team on using the integrated system to manage financial records effectively.

5) Monitor and optimize

Regularly review transaction logs and reports to identify discrepancies or areas for improvement.

Challenges and Solutions

- Technical setup: If the M-PESA API seems complicated, hire a developer or use simpler third-party tools.

- Data syncing delays: Ensure your internet connection is stable to avoid syncing issues.

- Costs of integration: Opt for cost-effective accounting software or manual data exports if your budget is tight.

Final thoughts

Integrating M-PESA with your accounting system is a smart move for any Kenyan business looking to streamline operations and improve financial management.

Regardeless of the nature of your business, this integration will save you time, reduce errors, and help you make data-driven decisions for growth.