Loans… we can’t seem to do away with them! Money is a scarce resource and we need it in our day-to-day activities. Let’s talk about an online loan system.

Well, loans are expenses and also a source of income. When you get into the loan business you need to be ready.

The loan business involves lending and management of many other assets. It also involves creating a good credit score.

One also needs to have a way to check on clients, credit scores, and many loan terms. It is crucial to keep the business professional.

Besides, we are digital! Everything is now turning online; from websites, money transactions, businesses, and many others.

What is a loan?

This is the money or assets we assign to an individual for a duration and we expect it back with an extra amount (interest).

It can also be something we give for something else; giving a computer to a theatre to manage their records.

Well, an individual can loan a company or other individuals or vice versa!

What is a loan system?

It’s a software system that automates the loan process. It offers an efficient easily configurable module for all loans.

It eliminates the workload and offers to assist in transactions. Besides, it also keeps safe details of all transactions and clients’ data.

They also provide records and statements as well as manage interest rates.

Why use a loan system?

Ease the process of lending

As stated the loan system automates the process of lending. It creates a workload-free environment to ease the lending process.

Every client deserves a fast, hassle-free environment. This is to help them transact fast and easily.

A transaction-free and secure; automated loan disbursal, credit checks, and many other workload-free tasks.

Creates paperless transactions

Papers take time to sign, sometimes also they may be displaced. This process is risky and also makes record keeping a bit hard.

The loan system however removes the paper transactions; with just a click of a button, one can access funds fast.

Besides, the records are safely backed up and are easy to access, no more going to the filing cabinet; safe from fire and other related calamities.

Improved security

Files are safely stored in a server instead of traditional filing systems. Also, the files are accessible with the correct credentials.

It also increases portability; one can access it from anywhere with the correct credentials and a good internet connection.

No need to worry about disaster, theft, and calamities destroying your files. It’s easy to share with the client easily whenever there are issues.

Superior customer experience

Everyone deserves a fast, easy, and hassle-free loan assessment. Loans at times are needed as an emergency and a loan system will automate all these.

Customers need not sign anything; they just accept the terms and conditions by clicking a button and funds come in.

This also promotes your brand, it also gives the customer a way to reach out to others and keeps them coming back.

Where to get a loan System?

There are many loan systems available for banks, unions, and many other lendings institutions. However, here is one of the best!

Best? Yes… Why?

- Provides statements and business reports on all transactions made.

- It is fast and easy to use.

- It is very affordable.

So what’s this online loan system?

Introducing Jisort: An online software for bankers, credit unions, lending organizations, and many other financial institutions.

Jisort is used to manage the clients’ information, keep track of their transactions and generate reports and business statements.

The Jisort System Demo:

Jisort has been up and running for over 6 years and serving thousands of institutions both local and international.

Jisort Core Banking System has successfully integrated with:

- Banks

- Mpesa

- PesaLink

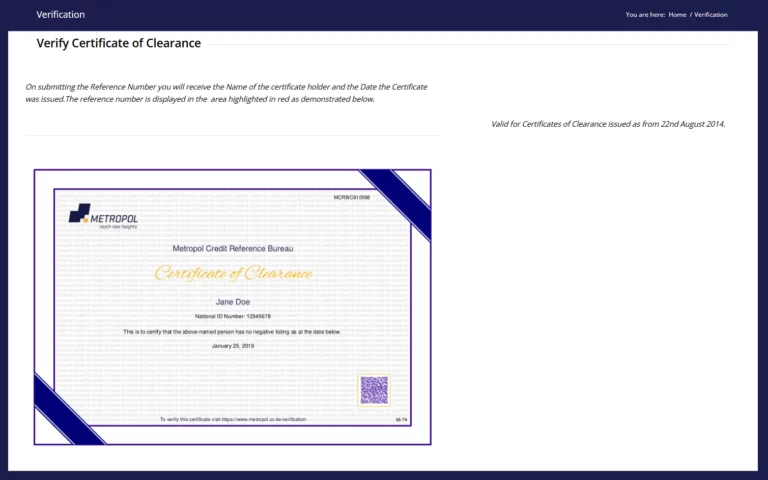

- Credit Reference Bureaus (CRBs)

- Vodacom

- Tigo

- Among others

Why Jisort?

- Affordable– for as low as $20, manage all your clients’ transactions and keep their data safe all in one platform.

- User-friendly- as an all-in-one platform, it is easy to navigate and access different clients without hassle.

- Payment modules- clients are not limited to only one payment module, Jisort is integrated with many payment modules.

- Easy to know how the business is doing- rich reporting and business analytic tools available for use.

- Reports and business statements- Jisort provides reports on all transactions made and provides statements too.

Jisort is the best online loan system. It offers a lot as a web-based software; besides, it’s easy to use.

It helps eliminate the workload by automating transactions. Besides, it provides a paperless transaction method that is safe.

Get the online loan system and ease of the work!