As an entrepreneur in Kenya, you’re stepping into a vibrant market where how people pay shapes your business success.

Payment methods in Kenya range from mobile apps to cold, hard cash, and knowing them is key to reaching your customers.

With over 30 million mobile subscriptions in a population of 54 million, digital payments are a big deal, but old-school methods still hold strong.

Your customers might tap their phones to pay for a coffee or hand over cash for a delivery. Each method has its own vibe and challenges.

Let’s break it down so you can choose what works for your business.

Why Payment Methods Matter for Your Business

Your customers want options that feel easy and safe.

If you only accept cash, you might miss out on tech-savvy shoppers. If you skip mobile payments, you could lose half the market.

Kenya’s payment scene is a mix of new and old. By offering the right mix, you build trust and boost sales.

Let’s dive into the top ways Kenyans pay today.

Payment Methods in Kenya

1) Mobile Money

Mobile money lets people send, receive, and pay using their phones.

In Kenya, it’s a game-changer, especially for small businesses.

You’ve probably heard of M-Pesa, run by Safaricom. It’s the king of mobile money, used by over 80% of adults.

Airtel Money is another option, but it’s less common.

Why mobile money:

- Easy to use: No bank account needed, just a phone.

- Everywhere: Even rural areas have M-Pesa agents.

- Fast: Payments hit instantly, no delays.

For your business, M-Pesa is a must.

Customers use it for everything—buying airtime, paying bills, or grabbing groceries. You can set up a PayBill or Till Number to accept payments smoothly.

Limits and Costs

M-Pesa has a daily cap of KES 500,000 (about $3,868).

That’s plenty for most small transactions. But watch out for M-Pesa fees —sending money costs a small percentage, and so does withdrawing cash.

Check Safaricom’s fee chart to stay sharp on costs. You don’t want surprises eating into your profits.

2) Cash and Cash on Delivery

Cash might feel old-school, but it’s alive in Kenya.

About 35% of online shoppers choose cash-on-delivery (COD). It’s big because some folks don’t trust paying online yet.

If you’re selling clothes or gadgets online, COD can win over cautious buyers.

They pay when the package arrives—no stress for them.

| Pros | Cons |

|---|---|

| Builds trust with new buyers | Risk of theft or fake notes |

| No tech needed | Slow to process and deposit |

| Works for all customers | Hard to track for accounting |

How to Handle Cash

Offer COD if you’re in e-commerce, but set clear rules. Maybe ask for a small deposit upfront to avoid no-shows.

And always double-check notes—fake cash is rare but real.

Cash works best alongside other methods. You don’t want to rely on it alone.

3) Card Payments

Debit and credit cards are picking up, especially in Nairobi and Mombasa.

Visa and MasterCard lead, with American Express trailing. About 28% of online purchases use cards.

Debit cards are more common as only 5.6% of Kenyans have credit cards. If you’re targeting urban buyers, cards are a solid option.

Why Cards Matter

- Convenient: Fast for online and in-store buys.

- Global: Tourists and expats love them.

- Trackable: Easy to manage your books.

Set up a card reader with a bank or a service like Pesapal. It’s worth the small setup fee for the sales boost.

Challenges with Cards

Some customers shy away from cards due to fraud fears.

Others hit bank limits on daily spending. Make sure your checkout feels secure—use trusted payment gateways to ease their minds.

4) Bank Transfers for For Big Deals

Bank transfers move money directly between accounts. In Kenya, PesaLink makes it instant for small amounts, while KEPSS handles big transactions for businesses.

If you’re selling high-value items like furniture or tech, transfers are common.

Customers feel safe knowing the bank’s involved.

When to Use Them

- B2B deals: Suppliers often prefer transfers.

- Big orders: Safer than cash for large sums.

- Online sales: Some buyers skip cards for transfers.

You can share your bank details or use a service like Popote Pay to simplify things. Just double-check payments clear before shipping goods.

Keep It Simple

Ask for proof of payment to avoid disputes. And don’t share sensitive bank info publicly—stick to secure channels.

Other Payment Platforms

5) Pesapal

Pesapal is a top digital payment service in Kenya.

You can make online payments using credit or debit cards. It also supports bill payments, airtime purchases, and flight bookings.

It’s a versatile platform that simplifies online transactions.

6) iPay

This is a real-time end-to-end payment processing and billing service provider established in 2010 with operations in Kenya, Uganda, Tanzania, and Togo.

It offers customized payment solutions for businesses, including mobile money, mobile banking, Pesalink, QR payments, PDQs, and card payment.

iPay accepts payments from various sources, including Visa, MasterCard, Kenswitch, M-Pesa, and Airtel Money.

You can use it for online and in-store payments, donations, and bill payments. It’s a flexible option that caters to different payment preferences.

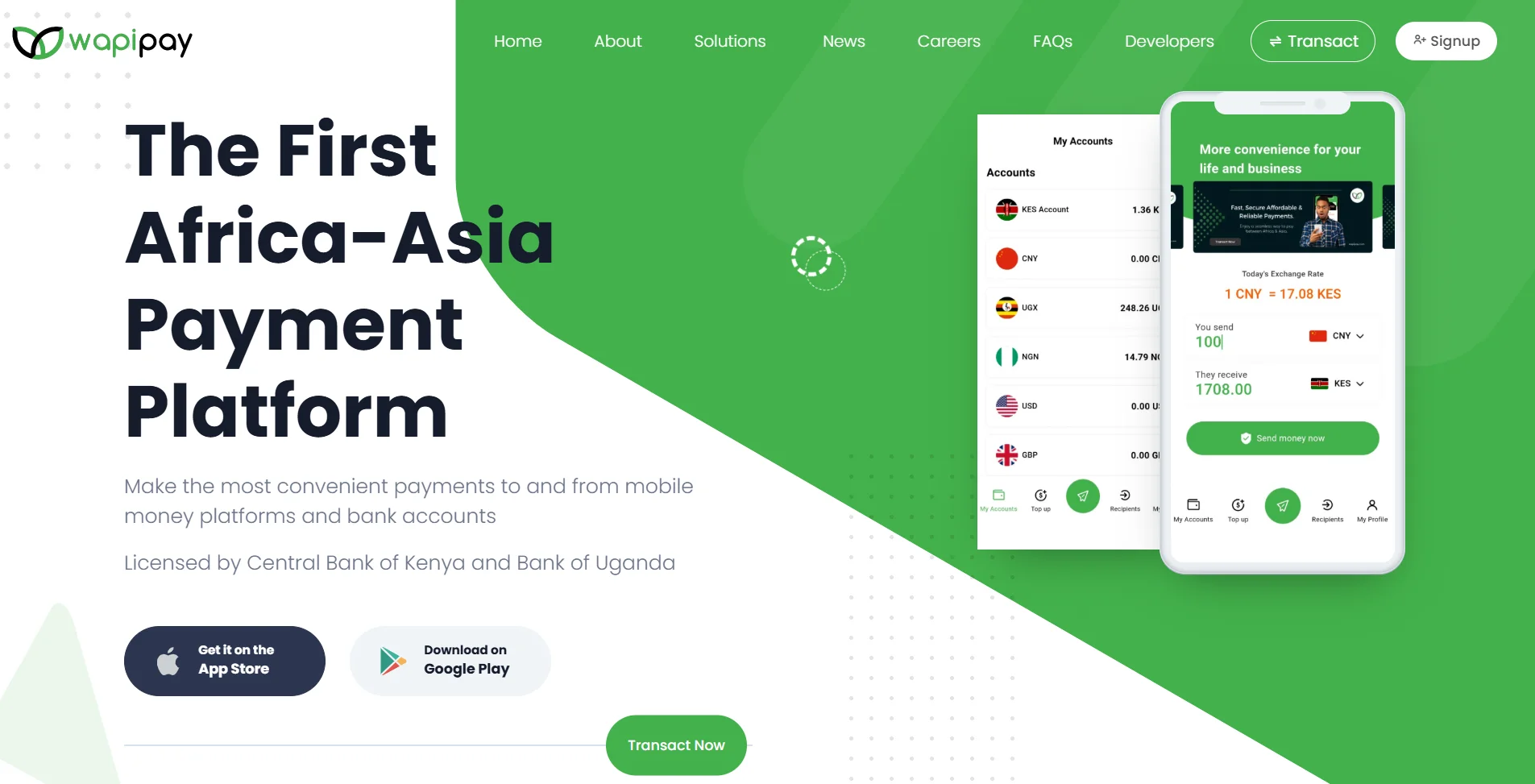

7) Wapipay

Wapipay is an Africa-Asia payment platform that supports B2B, merchant, and peer-to-peer payments.

It also offers remittance services at a low cost.

So, if you need to send or receive money internationally, Wapipay is a reliable choice.

8) Popote Pay: For Business Payments

Popote Pay is designed for businesses.

It offers spend management and payables automation services. You can make bulk payments and access unsecured loans for working capital.

It’s a powerful tool for managing your business finances efficiently.

9) IntaSend

IntaSend is an all-in-one online payments provider.

It offers digital wallets, mobile money transfers, and bill payments.

It currently supports Visa, Mastercard, ACH, and even Bitcoin. So whether you’re making a local or international payment, IntaSend has you covered.

Digital Wallets and New Trends

Beyond Mobile Money

Digital wallets like PayPal are growing, especially for freelancers and online sellers.

You can link PayPal to a local bank for withdrawals (Equity Bank), which takes a few days.

Other options include Buy Now, Pay Later (BNPL) services. These let customers pay in chunks, and they’re expected to hit $1.26 billion in 2024.

Why Try New Methods?

- Attract young buyers: Millennials love BNPL.

- Go global: PayPal opens international markets.

- Stay fresh: New tech keeps you ahead.

Cryptocurrency: A Small Spark

Crypto like Bitcoin is niche but buzzing.

Some tech-savvy Kenyans trade it, but it’s not mainstream yet. If you’re in a cutting-edge niche, maybe test it—but don’t bet big.

Tips to Choose Your Payment Methods

You don’t need every option, but a smart mix is key.

Here’s how to pick:

- Know your crowd: Mobile money for rural customers, cards for city folks.

- Start small: Add M-Pesa and cash, then grow to cards.

- Test and learn: Try BNPL for a month and see if sales jump.

Talk to your customers—what do they like? If half your orders are COD, keep it. If everyone’s on M-Pesa, make it your focus.

Make Payments Work for You

Kenya’s payment methods give you flexibility as an entrepreneur.

Mobile money like M-Pesa is non-negotiable—it’s fast and everywhere.

Cash keeps cautious buyers happy, while cards and transfers suit bigger deals.

Don’t sleep on new trends like BNPL or PayPal—they could set you apart. Mix and match to fit your business vibe. What’s your next step—adding a PayBill or testing COD?