Sustainability Linked Loans (SLLs) are changing how Kenyan businesses finance their operations while promoting environmental responsibility.

These innovative financial products tie loan terms directly to a company’s sustainability goals, creating powerful incentives for positive change.

Sustainability linked loans offer businesses in Kenya lower interest rates when they meet pre-defined sustainability targets, making them an increasingly popular choice for forward-thinking companies.

Kenya’s SLL market has seen remarkable growth recently, with major corporations embracing this financing model.

Safaricom, Kenya’s largest telecommunications provider, recently secured another KES 15 billion sustainability-linked loan, bringing the total facility to KES 30 billion. That’s a whopping 234Million USD in SLLs funding.

This clearly demonstrates the growing appeal of these financial instruments among industry leaders.

The rise of SLLs in Kenya represents a significant shift in how companies approach financing and sustainability.

As the market matures, expect to see more stringent standards and greater transparency requirements to maintain the integrity of these business loans while continuing to drive positive environmental and social outcomes.

The Framework of Sustainability Linked Loans

Sustainability Linked Loans (SLLs) operate within a structured framework that balances financial incentives with environmental and social progress.

These innovative financial instruments are gaining popularity in Kenya’s lending market as companies seek ways to align their financial strategies with sustainability goals.

Principles of SLLP

The Sustainability-Linked Loan Principles (SLLPs) form the backbone of all SLLs globally.

These principles were developed by a working party of experienced financial institutions and are jointly published by the Loan Market Association (LMA), Asia Pacific Loan Market Association (APLMA), and Loan Syndications and Trading Association (LSTA).

The SLLPs consist of five core components:

- Selection of Key Performance Indicators (KPIs) – These must be relevant, material, and core to the borrower’s business

- Calibration of Sustainability Performance Targets (SPTs) – Must be ambitious and meaningful to the borrower’s business

- Loan Characteristics – Financial terms that vary based on whether SPTs are met

- Reporting – Regular, credible updates on performance against SPTs

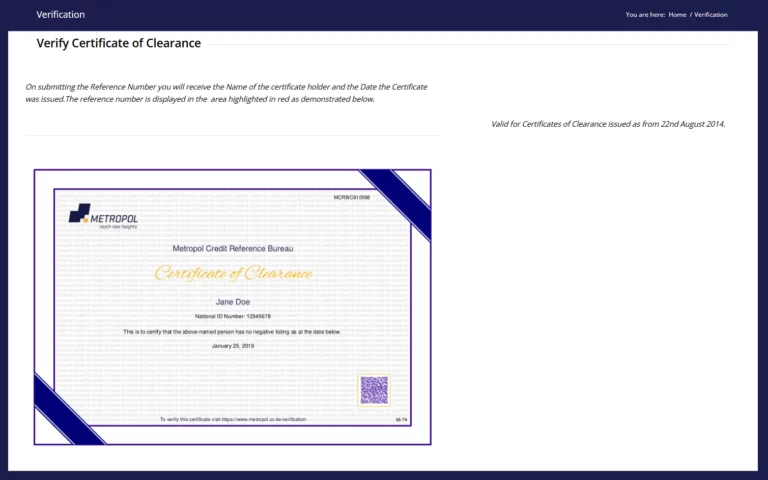

- Verification – Independent validation of performance

Unlike green loans, SLLs don’t restrict the use of proceeds to specific green projects.

Instead, they provide financial incentives — typically through margin reduction—when borrowers achieve their sustainability targets.

SLL Market Trends in Kenya

Kenya’s SLL market has shown remarkable growth since 2019, with major corporations like Safaricom securing significant sustainability-linked financing.

Key trends in Kenya’s SLL market include:

- Industry Diversification – Initial uptake in telecommunications and energy sectors is expanding to manufacturing and agriculture

- Local Bank Participation – More Kenyan banks are developing SLL products

- KPI Focus Areas – Carbon reduction, renewable energy adoption, and social impact indicators are most common

The Kenyan market is increasingly aligning with global standards while adapting KPIs to address local sustainability challenges like water scarcity and community development.

Foreign investors are showing greater interest in Kenyan SLLs as the market matures and reporting standards improve.

This is driving competitive pricing and more innovative structures.

Key Components of SLLs

When structuring an SLL, several critical components must be carefully designed:

KPI Selection:

- Must be relevant to borrower’s industry and operations

- Should address material ESG challenges (Environmental, Social, and Governance,)

- Typically include 2-5 indicators across environmental and social dimensions

SPT Calibration:

For sustainability performance targets:

- Targets must be ambitious yet achievable

- Should demonstrate improvement over industry benchmarks

- Need clear measurement methodology

Pricing Mechanism:

| Performance | Margin Impact |

| All SPTs met | Maximum discount (typically 5-10 bps) |

| Partial achievement | Partial discount |

| No SPTs met | No discount or potential premium |

The loan documentation must clearly define testing periods, reporting requirements, and verification procedures.

Most SLLs require annual reporting at minimum, with third-party verification of performance against targets.

You’ll need to consider how SPT achievement affects not just pricing but potentially other loan terms like covenant testing or availability periods.

The Role of Verification and Reporting

Verification and reporting form the backbone of any credible Sustainability Linked Loan (SLL).

These processes ensure that borrowers actually meet their sustainability targets and don’t just make empty promises.

Importance of External Verification

External verification adds credibility to your SLL commitments.

Without independent review, your sustainability claims might face skepticism from stakeholders and investors.

An independent external verification process helps prevent greenwashing — the practice of making misleading environmental claims.

This verification typically happens annually.

Your loan documentation should clearly state who can serve as an acceptable verifier. Industry best practices favor qualified third-party assurance providers with relevant expertise.

The Sustainability Coordinator (often your lead bank) may review verification reports before they’re shared with the wider lending group.

This extra step helps identify issues early.

If you fail to provide required verification, this could trigger a “Sustainability Breach” under your loan terms.

Such breaches might lead to financial penalties or affect your reputation.

Transparency in SLL Reporting

Regular reporting demonstrates your commitment to sustainability goals. Most SLLs require annual reporting at minimum, though quarterly updates are becoming more common.

Your reporting obligations typically include:

- Progress against agreed Key Performance Indicators (KPIs)

- Any challenges encountered in meeting targets

- Remedial actions taken if targets are missed

- Forward-looking sustainability strategies

A compliance certificate must accompany each report, confirming the accuracy of your data.

This document often requires executive-level sign-off.

Public companies increasingly align their SLL reporting with their broader ESG disclosures. This integration simplifies your reporting process and ensures consistency in your sustainability messaging.

Regulatory requirements for sustainability reporting continue to evolve in Kenya. Staying current with these changes helps you avoid compliance issues with your SLL commitments.

Sustainability-Linked Loans in Practice

Sustainability-linked loans (SLLs) are transforming Kenya’s corporate finance landscape by rewarding businesses that achieve their environmental, social, and governance goals.

These innovative financial instruments tie loan terms directly to sustainability performance.

Case Study: Safaricom’s Sustainability Loan Journey

Safaricom made headlines when it secured a KES 15 billion sustainability-linked loan, marking a significant milestone in Kenya’s sustainable finance sector.

The telecom giant structured this loan with specific Sustainability Key Performance Indicators (KPIs) aligned with its corporate strategy.

The loan features a margin ratchet mechanism that adjusts interest rates based on Safaricom’s ability to meet predetermined ESG targets.

When Safaricom achieves its sustainability goals, the company benefits from reduced borrowing costs.

Safaricom’s KPIs focus primarily on reducing greenhouse gas emissions in line with the Paris Agreement and improving its overall ESG rating.

The loan structure allows Safaricom flexibility as a revolving credit facility while maintaining accountability for environmental commitments.

Advancing Kenya’s Sustainability Agenda

SLLs are gaining traction in Kenya as market practice evolves and becomes more standardized.

These loans follow the Sustainability-Linked Loan Principles (SLLPs), which provide a framework for creating effective sustainability provisions.

You’ll find SLLs particularly valuable if you’re seeking to:

- Align your financing with your sustainability strategy

- Gain financial incentives for meeting ESG targets

- Demonstrate commitment to sustainability to stakeholders

- Access innovative financing options

Kenya’s financial institutions are increasingly supportive of businesses with robust sustainability performance.

Companies with clear, measurable targets related to carbon reduction, resource efficiency, and social impact are well-positioned to benefit from SLL structures.

The growing adoption of SLLs reflects Kenya’s broader commitment to sustainable development and the integration of ESG considerations into corporate decision-making processes.