Money is never enough! Are you looking for where to get online loan in Kenya?

Well, relax we got you, today we will learn where to get a loan from.

Everyone needs some extra cash that can always help out in case of an emergency, opportunity, or to add to the current budget.

We all know a loan is simply money lending from an individual or group to an individual or a group, in which the recipient incurs a debt.

So where do you get an online loan in Kenya?

1. Zenka

It’s a money lending app that allows customers to borrow from KSh500 to KSh30,000! Wow, that’s a lot of money when you are broke. The first-time customers get a 61-day loan payable in 2 installments.

Loan costs are calculated based on the loan period and the requested amount. The commission fee starts from 5% and the final cost of the loan will be presented when applying.

They also have an affiliate program where you get paid per customer joined through your invitations.

How to apply?

- Download and install the Zenka App

- Register by putting your correct details.

- After successful registration, start the application and choose the loan amount (within the given limit) and term on the sliders

- The total amount due will show the amount that needs to be repaid

- Tap the “GET LOAN” button

- You are done, wait for M-Pesa’s confirmation.

2. Tala

It’s a mobile application that allows one to get cash fast. Well, you just need to have the Tala app, register and go to loans.

First loans range from KSh 1,000 – 5,000 and can grow up to KSh 30,000 as you pay back your loans.

Applying for a loan:

- Download the Tala App

- Register by entering your correct details

- Open the Tala App and go through the loan application process. If approved, choose a payment period, then select the “Send my loan” button

- Done, wait for M-Pesa’s confirmation.

Charges:

- Offers a 30-day loan with a service fee as low as 7% and up to 19%.

- They also offer a 21-day loan with a service fee as low as 5% and up to 14%.

- Some customers may also qualify for additional loan terms. When your loan application is approved, review your options and choose what’s best for you.

3. Branch

It is another way where to get online loan in Kenya, it is a mobile application accessible to anyone. Their loans range from Ksh. 250-70,000.

They also have an affiliate program where you get paid for inviting someone to join Branch.

How to get a loan:

- Download and install the Branch App.

- Fill out your details.

- Proceed to Get a loan.

- Choose the duration of the loan and await M-Pesa’s confirmation.

Charges:

- Monthly interest rates: 2%- 16%

- Loan terms 4-48 weeks.

4. Okash

It started service in Kenya in 2018 to provide soft loans that are accessible and easier to pay.

They offer an affiliate program:

- Using a Promo Code which works when someone uses it as they register.

- Referral links- anyone who joins through your link gets paid Ksh4, and extra Kshs 300 when they receive their first loan.

To access the loan just follow this simple process:

- Get the Okash App

- Sign up by filling in your personal information.

- Go ahead and apply for a loan.

Their loan limit is up to Kshs 500,000.

5. Senti

It’s a money borrowing app that allows customers to access loans and pay them from their mobile phones. Besides, you only need a mobile phone with a registered Safaricom line and a national identification card.

The minimum you can borrow is Kshs. 1500.

The process of loan acquiring is simple:

- Download the Senti App.

- Register by filling in your correct details.

- Apply for a loan, get approved

- Wait for M-Pesa’s message confirmation.

Besides loans, Senti allows one to pay for bills like water and electricity as well as buy airtime.

6. Timiza

It was formed by Barclays Bank of Kenya now ABSA in March 2018. They aimed to provide soft loans that are easily accessible.

Applying for a loan is simple:

- Download the Timiza App

- Fill in your personal details.

- Apply for a loan

- Withdraw it from the app to M-Pesa.

Charges:

- Interest rate- 6.17% per month

Timiza also allows users to purchase credit, book a Taxi, check foreign exchange and also get insurance cover.

7. iPesa

It’s also of the latest credit apps in the country. It offers efficient, fast, and reliable money services to all customers.

They offer loans from Kshs 500- 50,000.

Applying for a loan is simple:

You need to have an Identification Card and an active Safaricom line.

- Download the iPesa app

- Fill in your personal information

- Apply for a loan

- Await confirmation message.

Charges:

- APR- 12%

- the shortest loan period is 91 days, the longest is 180 days

8. Zidisha

It’s also a credit app where one logs in and fills in personal data; it’s different from other credit apps for it allows other people to fund your loan requirements and later pay through Zidisha which allocates payments as per creditor.

For startup customers, they get a test loan from which the loan limit grows up to a maximum of Kshs. 1,128,681.

Borrowers pay a service fee of 5% of the loan amount, to cover the cost of transferring and administering the loan.

Get fast and instant loans from Zidisha.

9. Utunzi

It is also a money lender app that allows one to borrow from Kshs 500- 1,000,000. The repayment period is from 91 days- 36 months.

Charges:

APR- 12%.

Interest rate 12%

Kshs- 400 for account management.

10. Berry

It’s another Kenyan flexible mobile lending app. They aim to provide financial help whenever someone needs it.

Applicants must have an active Safaricom line and must have a National Identity Card, and access loans from Kshs 500- 50,000.

Berry also accesses your records to be able to get your loan plan.

Well, now you know where to get an online loan in Kenya, let’s learn a few important things to consider.

Are thinking of how to make extra cash from loans? Do you know what to create a borrowing solution? Well, Jisort is the right software for you.

What is Jisort and how does it work?

Jisort is a credit management software automating transactions in Microfinance Institutions, SACCOs, Banks, Cooperatives, Credit Unions, Lending Organizations, and other MFIs. Fully integrated with Mobile Money and Banks which helps keep records of all transactions made.

Jisort specializes in the development of banking systems and applications with the latest technology; it has been up and running for 6 years serving both local and international organizations.

The Jisort banking system is integrated with:

- Banks

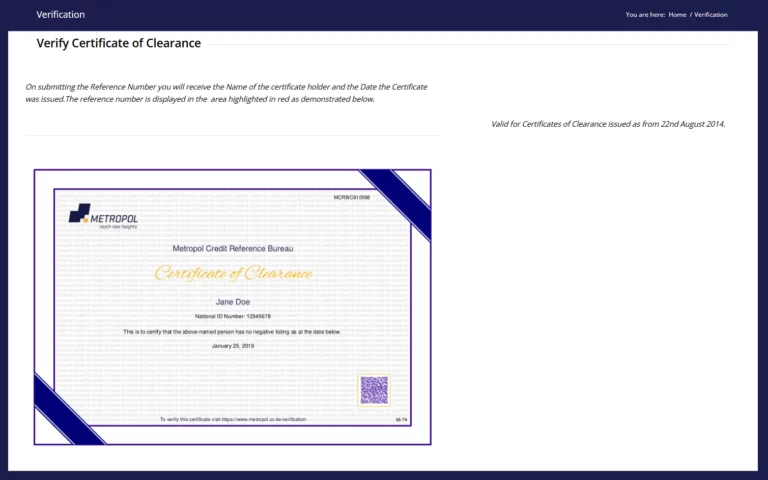

- Credit Reference Bureaus (CRBs)

- Mpesa

- PesaLink

- Vodacom

- Tigo

- Among others.

The microfinance payments are:

For those considering being creditors, this is the best management software.

Where to get online loan in Kenya article has given a guideline it’s up to you to find the best solution that works for you.

Loans are the best whenever you are running short on money. Besides, you never know when an emergency can happen, and having a way to access extra cash is great.

But before accessing loans many apps access your personal information to be able to know how much to credit you.