Read great posts and guides on topics such as lending, borrowing, saccos, invoicing, etc

-

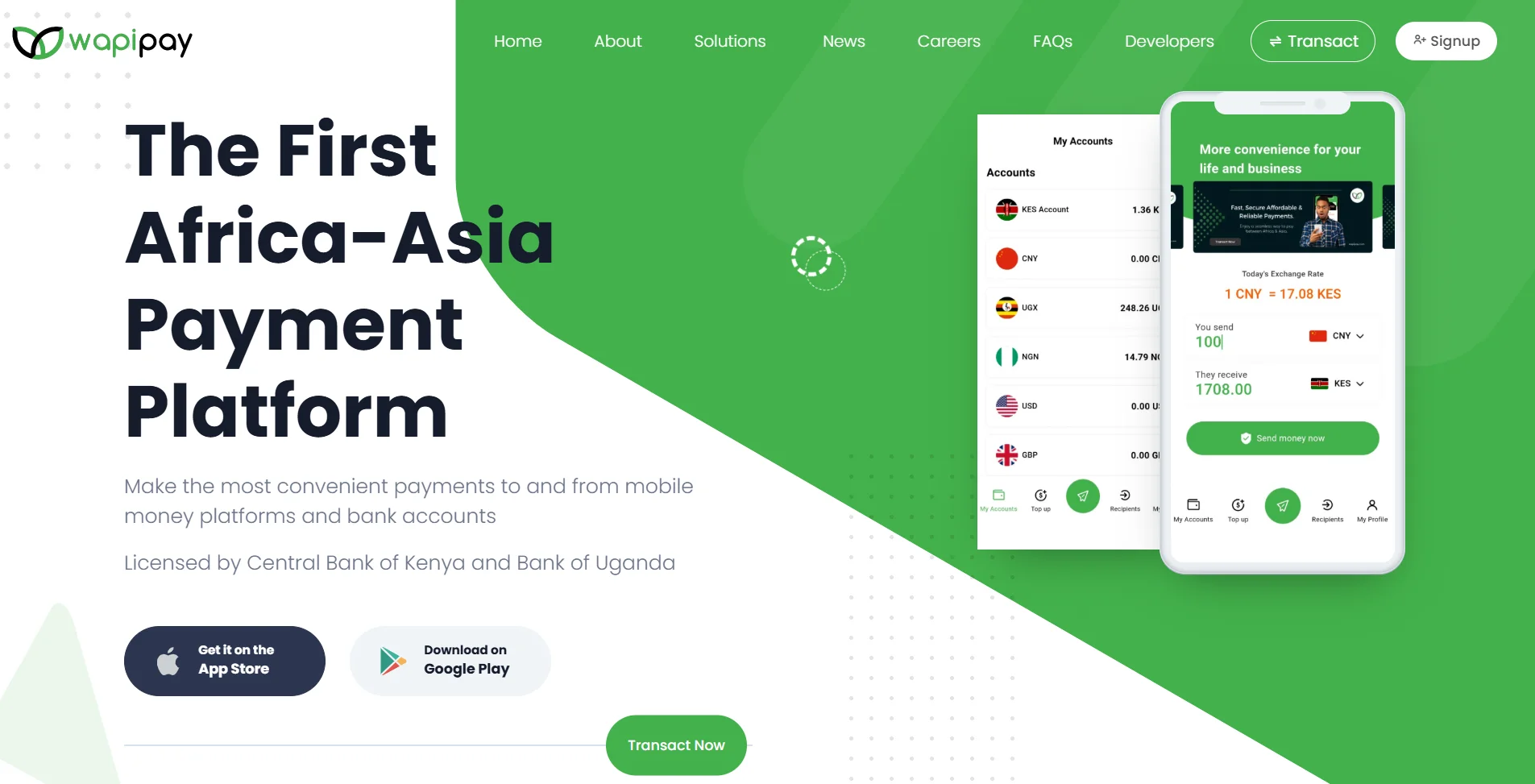

10 Innovative Startups Disrupting Fintechs in Kenya Today

Kenya’s financial technology sector has become a beacon of innovation across Africa. The country’s fintech landscape continues to evolve rapidly, with companies like Jisort leading the charge in digital financial services. From mobile money solutions to digital lending platforms, these companies are reshaping how Kenyans access and manage their finances. You know what’s fascinating? Kenya […]

-

10 Revolutionary Core Banking Trends Transforming Financial Services Today

The banking world isn’t just changing—it’s experiencing a complete metamorphosis. You know what’s fascinating? The core banking trends we’re witnessing today aren’t just minor tweaks to existing systems. They’re fundamental shifts that are rewriting the rules of how financial institutions operate, compete, and serve their customers. Ready to stay ahead of the curve? Visit Jisort.com […]

-

Why More SMEs Are Turning to Cloud Banking Software

Picture this: You’re running a growing business, juggling multiple financial accounts, and drowning in paperwork. Sound familiar? What you need is a cloud banking software. Ready to transform your business banking experience? Discover how Jisort’s cloud banking platform can streamline your financial operations and accelerate your growth starting today. The banking world has shifted dramatically […]

-

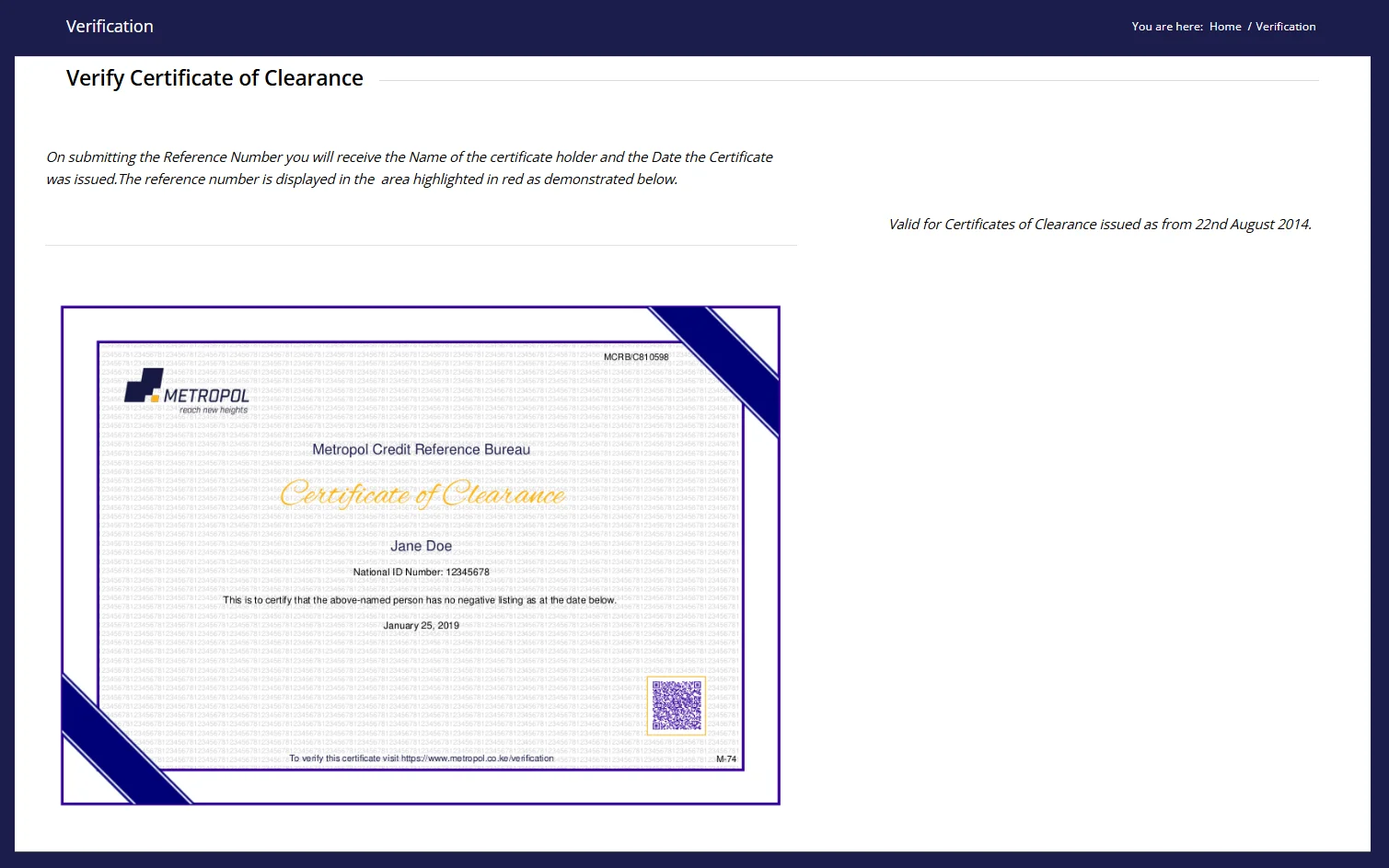

How to Check CRB Status in Kenya

If you’ve ever taken a loan or bought something on credit, your financial behavior is being tracked. In Kenya, this is done by the Credit Reference Bureaus (CRBs). These companies collect your borrowing and repayment records and give you a credit score. Your CRB status tells lenders if you’re likely to repay your loan or […]

-

What is Greenwashing: Of Corporate Environmental Deception

Ever seen a product with big green letters saying “eco-friendly” but wondered if it’s really good for the planet? You’re not alone. Greenwashing is when companies mislead customers by making false or exaggerated claims about how environmentally friendly their products or practices are. This deceptive marketing tactic has become more common as consumers care more […]

-

Sustainability Linked Loans in Kenya (Quick Overview)

Sustainability Linked Loans (SLLs) are changing how Kenyan businesses finance their operations while promoting environmental responsibility. These innovative financial products tie loan terms directly to a company’s sustainability goals, creating powerful incentives for positive change. Sustainability linked loans offer businesses in Kenya lower interest rates when they meet pre-defined sustainability targets, making them an increasingly […]

-

Startup Business Loans in Kenya (Everything You Need to Know in 2025)

Starting a business in Kenya can be exciting, but finding the right financing is often challenging. Many entrepreneurs struggle to secure the funds they need to get their ideas off the ground or expand their operations. Small business loans in Kenya are now more accessible than ever, with amounts ranging from Ksh 50,000 to 1 […]

-

What is NSSF?

Ever wondered what happens to your money when you contribute to the NSSF? The National Social Security Fund is Kenya’s government agency that collects, protects, invests, and distributes social security funds for workers. It serves as a safety net by providing retirement, survivor, and invalidity benefits to Kenyan workers and their families. Established in 1965, […]

-

Requirements for Starting a Business in Kenya: Essential Steps and Legal Documentation

Planning to start a business in Kenya? You need to know the legal requirements before diving in. Starting a business in Kenya requires registration with several key government bodies including the Kenya Revenue Authority (KRA), Social Health Authority (SHA), and National Social Security Fund (NSSF). The process begins with choosing the right business structure for […]

-

Business Categories for Registering a Business in Kenya (BRS)

When filling out official forms or exploring sector-based opportunities in Kenya, you’re often asked to pick your business type. That simple dropdown menu might seem unimportant — but understanding these categories is essential if you’re registering a business, applying for a license, or launching a professional service. This guide breaks it all down for you. […]

-

How to Calcualte VAT in Kenya for Your Business

To calculate VAT in Kenya, you need to understand the basic mechanism of VAT, which is a consumption tax applied to taxable goods and services at each stage of the supply chain. The standard VAT rate in Kenya is 16%, though some supplies are zero-rated (0%) or exempt. VAT is calculated as the difference between […]

-

9 Popular Payment Methods in Kenya

As an entrepreneur in Kenya, you’re stepping into a vibrant market where how people pay shapes your business success. Payment methods in Kenya range from mobile apps to cold, hard cash, and knowing them is key to reaching your customers. With over 30 million mobile subscriptions in a population of 54 million, digital payments are […]

-

How to Start a Money Lending Business in Uganda

Starting a money lending business in Uganda offers a promising opportunity, but it’s a venture that demands grit, planning, and strict adherence to the law. With only 9% of Ugandans accessing formal credit (Findev Gateway, 2005, adjusted for 2023 trends), the market for quick, accessible loans is vast and remains largely underserved. Small-scale traders in […]

-

How to Calculate New NSSF Contribution Rates in 2025

Learn how the new NSSF contribution rates affect you. Explore employee and employer deductions, including the updated Kshs. 72,000 salary cap, and 6% rate on

gross income. -

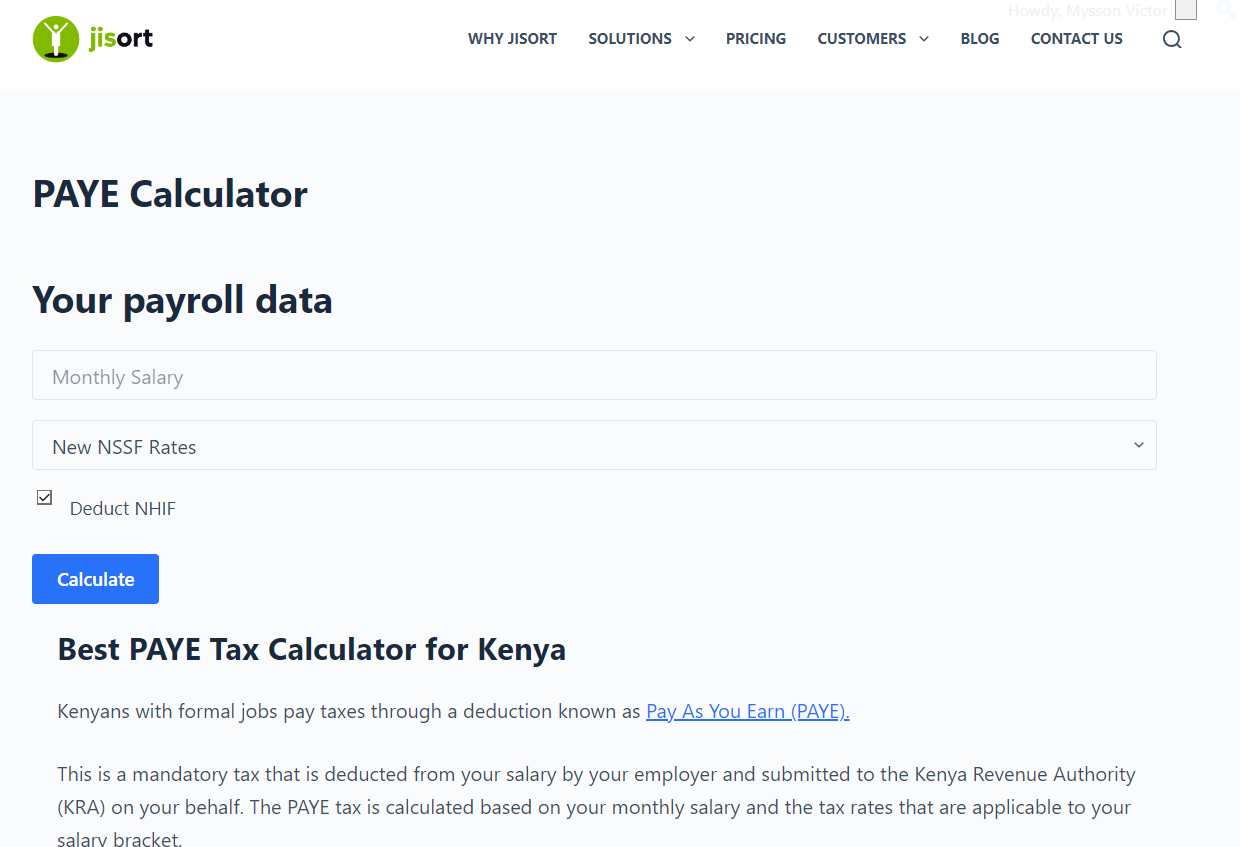

How to Calculate PAYE in Kenya

Understanding how Pay As You Earn (PAYE) works is essential for employees and employers in Kenya. PAYE ensures that taxes are deducted directly from salaries and remitted to the Kenya Revenue Authority (KRA). It applies to income such as salaries, bonuses, and allowances, making it a key part of your financial planning. So, whether you’re […]

-

Integrating M-PESA with Your Business Accounting Systems

M-PESA has become a vital tool for handling payments in Kenyan businesses. However, managing payments alone isn’t enough — you also need a seamless way to keep track of your transactions, monitor cash flow, and generate reports for better financial planning. That’s where integrating M-PESA with your accounting systems comes in. This integration can save […]

-

How to Use M-PESA Till Numbers to Boost Your Kenyan Business

M-Pesa till numbers make payments simple. Find out how to apply, use, and maximize this powerful payment solution for your business.

-

Non-Profit Organisation NPO Funding

Non-profit organizations (NPOs) rely on funding to drive their initiatives and make a tangible impact in the communities they serve. While general funding strategies are essential, knowing about popular and well-established NPO funds can significantly boost your fundraising efforts. These funds often support causes ranging from education and healthcare to environmental conservation and social justice. […]

-

How to Create a Catchy Lending Business Slogan (+ Examples)

Want a slogan that doesn’t suck? Most lending businesses have slogans that are about as exciting as watching paint dry. “Your trusted financial partner.” 😴 “Building a better tomorrow.” 😴 “Committed to your success.” 😴 Don’t be like them. Your slogan is your first impression. It’s your chance to grab attention, differentiate yourself, and make […]

-

Lending Business Mission and Vision (Guide + Examples)

Let me tell you about Sarah, a friend who transformed her struggling lending business into a market leader. The secret? It wasn’t just better rates or faster approvals. It was something more fundamental: a clear mission and vision that resonated with both her team and customers. Defining your lending business’s mission and vision isn’t just […]

-

Is Crypto Lending Profitable? (What They Don’t Tell You)

Is Crypto Lending Profitable? (The No-BS Guide to Earning Interest on Your Crypto) Let’s cut to the chase. You’re here because you’ve got some crypto, and you’re wondering if lending it out is a good way to make some extra cash. The short answer? It can be. But like anything in the wild west of […]

-

How to Start a Crypto Lending Business (Everything You Need to Know)

Want to dive headfirst into the wild world of crypto lending? You’re not alone. It’s like the Wild West out there, full of opportunity and risk. But don’t worry, I’m here to guide you. This ain’t no get-rich-quick scheme. This is a business, and like any business, it takes work. But if you’re willing to […]

-

11 Best Books on Lending Business (Must Read)

Want to crush it in the lending business? You need knowledge. You need strategies. You need an edge. And guess what? Books are your secret weapon. Forget those dusty, boring textbooks. I’m talking about books packed with real-world tactics, insider secrets, and actionable advice to skyrocket your lending game. This is a hand-picked selection of […]

-

How to Make Money Lending Money (Like a Boss)

Want to make your money work for you? Tired of watching your savings gather dust in a low-yield account? Then listen up, because we’re about to dive deep into the world of making money by lending money. This isn’t your grandma’s savings account – we’re talking about strategies that can generate serious returns. Forget the […]

-

The Ugly Truth About Microfinance: Why It’s NOT Always the Hero

Microfinance. It sounds like a magic bullet, right? Give small loans to poor entrepreneurs, they start businesses, lift themselves out of poverty, everyone wins. Not so fast. While microfinance has helped millions, it’s got a dark side. And if you’re thinking about taking a microloan, or even just want to understand the world better, you […]

-

What’s the REAL Legal Lending Rate in the Philippines?

Want to avoid getting ripped off or worse, landing in legal trouble when lending money in the Philippines? Then you NEED to understand the legal lending rate. It’s not just about protecting your wallet, it’s about staying on the right side of the law. Let’s break it down, Alex Hormozi style. The Baseline: What the […]

-

The 4 C’s of Lending: Your Secret Weapon to Dominate the Money Game

Want to run a lending business that doesn’t just survive, but thrives? Then you need to master the 4 C’s of lending. This isn’t some fluffy theory – it’s the bedrock of smart lending decisions. Get this right, and you’ll minimize risk and maximize profits. Screw it up, and you’re setting yourself up for a […]

-

The Profitability Principle of Lending: How Banks Make Money (and How You Can Too)

Banks aren’t charities. They’re businesses. And like any business, their primary goal is to make a profit. This brings us to the profitability principle of lending, the beating heart of any bank’s operation. What is the profitability principle of lending? Simply put, it means that banks must lend money at a rate that exceeds their […]

-

7 Key Metrics to Measure the Profitability of Your Lending Business

If you’re in the lending business, you know that profitability isn’t just about how much money you’re lending out. It’s about how effectively you’re managing your resources, mitigating risks, and generating returns. But how do you really know if your lending business is as profitable as it could be? That’s where measuring your lending business […]

-

57 Funny Names for Your Loan Business That Will Catch Attention

Starting a loan business can be a lucrative venture, but in a crowded market, it’s essential to stand out from the competition. One way to do this is by choosing a catchy and memorable name for your business. While traditional names like “ABC Loans” or “XYZ Lending” may work, why not add a touch of […]

-

Top #10 Lending Industry Trends You Need to Know

Staying ahead of the curve is crucial for success. A myriad of trends are shaping the future of lending, driven by technological advancements, changing consumer preferences, and regulatory shifts. In this comprehensive blog post, we’ll explore the top 10 lending business industry trends that you need to be aware of to thrive in the coming […]

-

#6 Biggest Challenges Faced by Lending Businesses (and How to Solve Them)

Lending businesses play a crucial role in fueling economic growth and empowering individuals and companies to achieve their goals. But let’s face it: running a lending business isn’t a walk in the park. As someone who’s been in the trenches, I’ve seen firsthand the hurdles that can trip up even the most seasoned lenders. Today, […]

-

How to Create Accurate Financial Projections for Your Lending Business

Let’s cut to the chase. If you’re running a lending business, accurate financial projections aren’t just nice to have – they’re critical to your survival and growth. I’ve seen too many lending businesses crash and burn because they couldn’t forecast their future accurately. But here’s the thing: creating reliable financial projections isn’t rocket science. With […]

-

Latest Insurance Requirements for a Lending Business

As a lending business, you are responsible for managing significant risks and liabilities. Protecting your assets and operations from potential losses is crucial, and having the right insurance coverage is essential. In this comprehensive guide, we’ll explore the insurance requirements for a lending business, covering various types of policies and their importance. Why Insurance Matters […]

-

7 Easy Steps to Starting a Lending Business Without Experience

Ever dreamed of being your own boss in the financial world? Want to help people achieve their goals while building a profitable business? Look no further than starting your own lending business. Now, I know what you’re thinking. “But I don’t have any experience in lending!” Don’t worry – I’ve got you covered. In this […]

-

7 Easy Customer Acquisition Strategies Every Lending Business Should Try

Lending business market is cutthroat! Standing out from the competition is no easy feat. With interest rates fluctuating and economic uncertainties looming, lenders face an uphill battle in attracting new borrowers. But here’s the thing: customer acquisition doesn’t have to be a Herculean task. In fact, with the right strategies in place, you can turn […]

-

7 Game-Changing Growth Hacks to Boost Your Lending Operations

Want to 10x your lending business without burning cash on ads? I’ve got you covered. In today’s cutthroat financial landscape, standing still is the same as moving backward. If you’re not constantly innovating and finding new ways to grow your lending business, you’re leaving money on the table. That’s where growth hacking comes in. It’s […]

-

7 Proven Exit Strategies for Lending Businesses: Which One is Right for You?

You’ve built a successful lending business from the ground up. Your hard work has paid off, and now you’re considering your next move. Maybe you’re ready to retire, or perhaps you’re itching to start a new venture. Whatever your reason, it’s time to talk about exit strategies for lending businesses. In this post, we’re going […]

-

How to Value a Lending Business in 7 Simple Steps

Ever wondered how to value a lending business? You’re not alone. Whether you’re looking to buy, sell, or simply understand the worth of a lending operation, nailing down an accurate valuation is crucial. But here’s the thing: valuing a lending business isn’t like valuing your average mom-and-pop shop. It’s a whole different ballgame. You’re dealing […]

-

Pros and Cons of Using Peer-to-Peer Lending Platforms for Your Business

Let’s face it: getting funding for your business can be a real pain in the ass. Traditional banks often treat you like a number, not a person with dreams and ambitions. They want perfect credit scores, years of profitable history, and your firstborn child as collateral. But what if I told you there’s another way? […]

-

A Beginner’s Guide to Marketplace Lending Vs. Traditional Lending

When it comes to borrowing money, you’ve got options. And in today, those options are expanding faster than ever. One of the hottest topics in the finance world is marketplace lending vs traditional lending. If you’re scratching your head wondering what that means, don’t worry – I’ve got you covered. As someone who’s been in […]

-

11 Proven Marketing Tactics for Growing Your Lending Business

Let’s cut to the chase: if you’re not actively marketing your lending business, you’re leaving money on the table. Plain and simple. In today’s hyper-competitive financial landscape, having a solid product isn’t enough. You need to get in front of your ideal customers, showcase your value, and build trust. That’s where effective marketing strategies for […]

-

How to Secure Funding for Your Small Lending Business

Starting a small lending business can be an exciting venture, but let’s face it: getting the capital to kickstart your operations is often the biggest hurdle. I’ve been there, staring at my business plan and wondering, “How do I get a loan for a small lending business?” It’s a question that keeps many aspiring entrepreneurs […]

-

10 Risks to Watch Out for When Starting a Lending Business

Starting a lending business can be an exciting and potentially lucrative venture. But let’s be real – it’s not all smooth sailing. There are significant risks of starting a lending business that you need to be aware of before diving in headfirst. I’ve been in the financial industry for over a decade, and I’ve seen […]

-

How to Choose a Reputable Online Lending Business

Are you a small business owner looking for the best small business loans? Choosing the right online loan can be a daunting task, but it’s crucial for the success of your business. In this comprehensive guide, we’ll walk you through the process of how to choose a reputable online lending business that meets your specific […]

-

9 Best Loan Management Software for Student Loans

As student loan debt continues to rise, with over 44 million borrowers owing a staggering $1.7 trillion, managing loans efficiently has become more critical than ever. In 2024, financial advisors and borrowers alike are turning to the best loan management software to simplify the process, reduce costs, and ensure timely repayment. Here are the top […]

-

Latest Types Of Lending Software Explained + Examples

Lending software is a crucial tool for financial institutions, lenders, and businesses involved in the lending process. With the right software, you can streamline your lending operations, manage loans more efficiently, and improve the overall customer experience. In this ultimate buying guide for lending software, we’ll explore the different types of lending software available and […]

-

9 Best Loan Management Software with Customizable Reports

Are you a lending business looking for the best loan management software to streamline your operations and provide excellent service to your customers? Look no further! In this blog post, we’ll explore 9 top loan software options with customizable reports and dashboards that can help you efficiently manage your loan portfolio and make data-driven decisions. […]

-

How to Implement Lending Software (Right Way)

Are you looking to streamline your lending business and automate key processes? Implementing the right loan management software can make a huge difference in efficiency, profitability, and customer satisfaction. In this post, we’ll explore how to implement lending software in your business to take your operations to the next level. Why Lending Software is Essential […]

-

Does Lending Business Software Improve Customer Satisfaction?

As a lending business, providing an exceptional customer experience is paramount to your success. One of the key factors in ensuring customer satisfaction is loan management. By utilizing advanced loan management software, you can streamline your lending operations, automate processes, and elevate your customer experience to new heights. In this blog post, we’ll explore how […]

-

Can Lending Software Help Me Improve Loan Approval Times? What To Know

As a lender, one of your top priorities is to streamline your loan approval process and reduce the time it takes to get loans approved and funded for your customers. In today’s fast-paced, digital world, borrowers expect quick decisions and rapid access to capital. This is where lending software comes in. But you may be […]

-

8 Best Lending Business Software for Real Estate Loans

The best lending business software for real estate loans can streamline your operations, improve efficiency, and boost your bottom line. In the competitive real estate lending market, having the right tools can make all the difference. Whether you’re a small independent lender or a large mortgage company, the right software can automate tasks, improve accuracy, […]

-

How to Choose the Right Lending Software for Your Business

Choosing the right lending software is crucial for the success of your lending business. The lending industry is constantly evolving, and having the right software solution can make a significant difference in your ability to meet your business goals and stay competitive. In this blog post, we’ll explore the key factors to consider when selecting […]

-

7 Best Lending Business Software with Customer Portal

Looking for the best lending business software with customer portal to automate your loan management and origination in 2024? Check out our top picks for end-to-end digital lending solutions to grow your lending business. What is Loan Origination Software? Loan origination software (LOS) is a digital lending platform designed to automate and streamline the entire […]

-

6 Best Affordable Lending and Accounting Software for Nonprofits

Finding the best accounting software for nonprofits can be a challenge, especially with the unique needs and often limited budgets of nonprofit organizations. Nonprofits have different requirements than traditional businesses, and the right nonprofit accounting software should offer features tailored to these specific needs, including fund accounting, donation management, and financial reporting. This article will […]

-

6 Best Lending Business Software for P2Peer Lending

P2P lending, or peer-to-peer lending, is a type of direct lending that matches borrowers with lenders through an online lending platform. It eliminates the need for traditional intermediaries such as banks, creating a more efficient and cost-effective lending process. The rise of P2P lending has led to the development of specialized lending software that facilitates […]

-

Compliance Requirements for Lending Software: Best Practices to Ensure Fair and Secure Lending

Introduction to Compliance and Its Critical Role in the Lending Industry Compliance is a critical aspect of the financial services industry, particularly when it comes to lending. With the complex nature of financial regulations and the potential for significant consequences in the event of non-compliance, lenders must have a solid understanding of the compliance requirements […]

-

7 AI-Powered Loan Origination Software for Lenders

The lending industry is undergoing a significant transformation as lenders increasingly adopt AI-powered loan origination software to streamline their loan origination processes. AI-powered loan origination software for lenders offers a range of benefits, including faster loan approvals, improved accuracy in credit decisioning, and enhanced borrower experiences. In this blog post, we will discuss seven of […]

-

Top 7 Lending Business Software with Mobile App for Borrowers

The lending industry is rapidly evolving, with borrowers increasingly demanding faster, more efficient, and accessible loan processes. Lending business software has become essential for lenders to streamline loan origination, improve borrower experiences, and enhance overall efficiency. Here, we’ll explore seven lending business software solutions that offer mobile apps for borrowers, providing convenient and flexible access […]

-

9 Best Loan Management Software for Mortgage Brokers

Are you a mortgage broker looking for the best loan management software to streamline your business? You’ve come to the right place! In this blog post, we will discuss the seven best mortgage CRM and loan servicing software options on the market today. But first, what is loan management software, and why do mortgage brokers […]

-

7 Must-Have Features of Loan Origination Software for Lenders

The loan origination system is an essential component of any lending institution, and in today’s digital world, having a robust loan origination software with the right features can be a game-changer. Loan origination software is designed to streamline and automate the loan origination process, making it more efficient and cost-effective for lenders. The top features […]

-

5 Best Cloud-Based Lending Software for Credit Unions

Credit unions need to stay competitive and efficient to meet the diverse lending needs of their members. This is where cloud-based lending software for credit unions comes in. By adopting these innovative solutions, credit unions can streamline their lending processes, make better credit decisions, and ultimately enhance their members’ financial well-being. In this blog post, […]

-

#9 Best Lending Business Software for Small Banks in 2024 (Compared)

The financial landscape for small banks is rapidly evolving. Staying competitive requires adopting the best lending business software for small banks that streamlines operations, enhances customer experience, and mitigates risk. This comprehensive guide will delve into the top loan management software options for small banks in 2024, exploring their features, benefits, and how they can […]

-

Small Lending Business Tips in the Philippines: A Comprehensive Guide

If you’re thinking of starting a small lending business in the Philippines, there are several important small lending business tips in the Philippines that you should keep in mind. The lending industry in the country is growing, and there is a demand for small loans from individuals and small businesses. With the right approach and […]

-

Is Online Lending Legal in the Philippines? What To Know

Online Lending in the Philippines: What You Need to Know The rise of online lending apps in the Philippines has provided Filipinos with easy access to loans. However, with this convenience comes the question of whether these online lending apps are legal and if they comply with lending regulations in the country. So, is online […]

-

#5 Types of Business Loans in the Philippines You Should Know

When it comes to starting or expanding a business in the Philippines, one of the most important considerations is financing. Fortunately, there are various types of business loans available to small and medium-sized enterprises (SMEs) in the country. In this blog post, we will discuss the different types of business loans available in the Philippines, […]

-

How to Register a Lending Business in the Philippines: A Step-by-Step Guide

The Philippines has a growing demand for financial services, making it a promising market for entrepreneurs who want to establish lending businesses. However, before you can start offering loans, it’s crucial to understand the legal framework and registration process. In this blog post, we’ll provide a step-by-step guide on how to register a lending business […]

-

Is Money Lending Business Illegal in the Philippines? A Guide for Lenders and Borrowers

The Philippines is an emerging market with a substantial demand for easily accessible financial solutions. The lending industry plays a crucial role in fulfilling this need. But, if you’re considering venturing into the money lending business, it’s essential to ask a critical question: is lending business illegal in the Philippines? The Short Answer No, lending […]

-

Is Lending a Good Business in the Philippines? Read Before You Start

The Philippines is a rapidly developing nation with a growing economy. This growth creates a strong demand for financial services, particularly lending. If you’re considering starting a business in the Philippines, the lending industry could be a lucrative option. But is lending a good business in the Philippines? In this blog post, we’ll delve into […]

-

How to Start a Lending Business in the Philippines

The lending industry in the Philippines is a thriving sector, catering to the financial needs of individuals and businesses alike. Lending companies provide loans to borrowers, typically charging interest rates on the principal amount borrowed. This business model allows lenders to generate revenue while offering financial solutions to those in need. In the Philippines, the […]

-

Requirements for Lending Businesses in the Philippines

The Philippines is an emerging market with a growing demand for financial services. Lending businesses play a crucial role in filling the gap between traditional banks and those who may have difficulty accessing credit. Opening a lending business in the Philippines can be a viable entrepreneurial path, but understanding the regulatory framework is essential before […]

-

Types of Lending Business: What You Need To Know

What are Lending Businesses? Lending businesses are financial institutions that provide loans or credit to individuals, businesses, and organizations. They play a crucial role in the economy by facilitating access to capital, enabling borrowers to finance various needs, such as purchasing homes, starting businesses, or funding personal expenses. The Importance of Lending Lending is essential […]

-

Does Fair Lending Apply to Business Loans? What You Need To Know

Introduction to Fair Lending Laws Fair lending laws are a set of regulations designed to prevent discrimination in lending practices. These laws aim to ensure that all applicants have an equal opportunity to access credit, regardless of their race, color, religion, national origin, sex, marital status, age, or other protected characteristics. The key fair lending […]

-

Digital Lending Business Model Explained

Digital lending, also known as online lending or fintech lending, is a rapidly growing industry that leverages technology to streamline the borrowing process. Unlike traditional lending methods, digital lending platforms use automated systems and advanced algorithms to evaluate loan applications, assess risk, and approve or deny loans. The digital lending process typically involves the following […]

-

Money Lending Business Challenges And How To Overcome

Regulatory Compliance and Legal Hurdles The money lending business operates within a complex web of regulations and legal frameworks. Failure to comply with these can result in severe penalties, fines, or even the revocation of operating licenses. Lenders must navigate a maze of laws and guidelines governing: These regulations vary across different jurisdictions, making it […]

-

Can LLP Do Money Lending Business? A Comprehensive Guide

Limited Liability Partnerships (LLPs) are popular business structures, offering flexibility and limited liability to partners. With the rise of alternative finance and peer-to-peer lending, a question arises: can LLP do money lending business? While the concept might seem lucrative, there are specific regulations and essential considerations surrounding lending practices for LLPs. This blog post dives […]

-

How To Pick the Best Name for Money Lending Business (+ Ideas)

In the competitive world of business, your company’s name is often the first impression potential customers will have. A well-chosen name can communicate your brand’s values, establish credibility, and leave a lasting impression. This is especially crucial in the money lending industry, where trust and professionalism are paramount. A strong business name can: On the […]

-

Mortgage Business Pros And Cons You Ignored

The mortgage industry plays a vital role in the real estate market, facilitating the process of buying and owning a home for millions of people. A mortgage business is a company that specializes in lending money to individuals or entities for the purpose of purchasing or refinancing residential or commercial properties. The primary function of […]

-

Lending Business Analyst? How To Get That Job

Introduction to Lending Business Analyst Roles and Responsibilities In the lending industry, business analysts play a crucial role in bridging the gap between business needs and technological solutions. These professionals are responsible for analyzing and documenting the requirements for lending processes, systems, and procedures. During an interview for a lending business analyst position, candidates can […]

-

Naming Your Microfinance Business: A Comprehensive Guide

Microfinance is a form of financial service that provides small loans, savings, and other basic financial services to individuals and small businesses who lack access to traditional banking services. It plays a crucial role in promoting economic development, poverty alleviation, and financial inclusion, particularly in developing countries. The concept of microfinance emerged from the realization […]

-

How To Craft A Winning Microfinance Business Plan in India

Microfinance has emerged as a powerful tool for financial inclusion and poverty alleviation in India. It involves providing small loans, savings, insurance, and other financial services to individuals and small businesses who lack access to traditional banking facilities. The importance of microfinance in India can be attributed to the following reasons: In India, microfinance has […]

-

Microfinance Bank Business Model Explained

Microfinance institutions play a pivotal role in driving financial inclusion and economic empowerment, particularly in underserved communities. A microfinance bank business model is specifically designed to offer financial services to those who are typically excluded from traditional banking systems, such as the poor, low-income earners, and small businesses. In this blog post, we will explore […]

-

How to Start a Microfinance Business in Zimbabwe

Microfinance is a form of financial services that provides small loans, savings opportunities, and other basic banking services to individuals and small businesses who lack access to traditional banking systems. In Zimbabwe, where a significant portion of the population lives in poverty and has limited access to formal financial institutions, microfinance plays a crucial role […]

-

How Create A Strategic Blueprint for Microfinance Success

Introduction to Strategic Planning for Microfinance Businesses Having a well-crafted strategic plan is essential for success. A strategic plan serves as a roadmap, guiding your organization’s decisions and actions towards achieving its mission and goals. This comprehensive document outlines your vision, objectives, and the strategies to attain them, ensuring that your microfinance business remains focused […]

-

Is Money Lending Business Profitable? What To Know

Money lending has long been an important part of the economy. Lending money to individuals and businesses in exchange for interest has long been an effective business strategy. The money lending industry has evolved and grown over time, offering a variety of loan forms and solutions to satisfy changing market demands. However, before starting a […]

-

Best Microfinance Software for Companies in Kenya

Emerging countries have a wealth of creativity and entrepreneurial spirit, but obtaining funding takes a lot of work. Microfinance can be extremely beneficial in this situation. Microfinance institutions (MFIs) play a critical role in promoting financial inclusion and empowering impoverished individuals and businesses. Adopting high-quality Microfinance software can help these organizations achieve their goals more […]

-

Top 5 Best Software For Microfinance Companies

The world of microfinance has shown to be a game-changer by granting access to financial services for marginalized and unbanked populations. The rapid advancement of technology has made it imperative to have innovative software solutions that cater to the specific needs of Microfinance. Microfinance software is meant to assist organizations in accessing, managing, and monitoring microfinance […]

-

#10 Profitable Microfinance Business Ideas

Microfinance refers to providing financial services, like loans, savings accounts, and insurance, to low-income individuals and communities. Microfinance institutions aim to support entrepreneurship and small business growth for those who may not have access to traditional banking. Some key points about microfinance: Profitable Microfinance Business Ideas Microfinance opens up doors for new business ideas for […]

-

The Ultimate Guide to ASPEKT Microfinance Software

Microfinance institutions (MFIs) play a vital role in driving financial inclusion by empowering underserved communities and businesses. To succeed in their mission, MFIs need powerful software solutions that can streamline operations, increase efficiency, and enhance customer service. ASPEKT Microfinance Software is one such solution designed to meet the unique needs of the microfinance sector. Let’s […]

-

Bijli Microfinance Software: Is It The Best For You?

Microfinance institutions (MFIs) play an essential role in providing financial services to underserved and low-income populations. These services include savings accounts, small loans, and insurance, all designed to financially empower individuals and communities often excluded from traditional banking. Bijli microfinance software is a specialized solution created to streamline the operations of MFIs. Its focus on […]

-

Money Lending Business Plan (Example and How to Create One)

A money lending business plan serves as an invaluable strategic guide for establishing and operating a successful lending operation. Crafting a comprehensive plan walks you through critical thinking on all facets of your envisioned lending business, including: Essentially, it encompasses detailed blueprint of your planned venture at launch and for years to come. Having this […]

-

Money Lending Business Strategy Example + Ideas

Starting a money lending business can be a profitable endeavor if done right. With proper planning and strategy, you can build a sustainable lending business that provides value to customers while generating steady revenue. Here is an overview of key things to consider when developing a money lending strategy: Crafting an effective strategy lays the […]

-

Top 7 CRM For Loan Management

The top 7 CRM for loan management provide essential tools for loan officers to manage, track, and nurture relationships with leads and clients. Here are the top 7 CRMs for loan management, along with their features and prices: Retool Retool is a versatile platform that allows users to build custom internal tools for various purposes, […]

-

Top 7 Free Loan Management Software

Loan management software is a crucial tool for lending institutions to manage their loan portfolios efficiently. It helps automate the loan origination process, track payments, and manage delinquencies. In this blog post, we will discuss the top 7 free loan management software solutions available in the market. We will cover what each software does, its […]

-

Top 7 Loan Management Software in South Africa

Loan management software is an essential tool for any financial institution that offers loans. It helps to streamline the loan process, from application to repayment. In South Africa, there are several loan management software options available. In this blog post, we will discuss the top 7 loan management software in South Africa, their features, and […]

-

What is the Difference Between LOS and LMS?

What is the Difference Between LOS and LMS? Los and LMS are both acronyms commonly used in Finance, but they refer to different stages of the loan lifecycle and have distinct functions. Here’s a breakdown of the key differences: LOS – Loan Origination System: A Loan Origination System (LOS) is a specialized software platform used […]

-

Top #7 Loan Management Software for Small Lenders

The top 7 loan management software for small lenders provide a range of features to streamline the lending process. These software solutions offer capabilities such as loan origination, servicing, and management, as well as integrated analytics and customer monitoring. Here are the 7 loan management software for small lenders, along with their key features and […]

-

Jayam Microfinance Software Suite: Read Before Using

The Jayam Microfinance Software Suite is a powerful and feature-rich solution designed to cater to the needs of startups, SMEs, agencies, and enterprises in the microfinance industry. Developed by Jayam Solutions Private Limited, this software suite offers a wide range of features and functionalities to streamline operations and enhance efficiency. Key Features of Jayam Microfinance […]

-

Top 5 Microfinance Software Prices

Microfinance software is an essential tool for microfinance institutions, village banks, MDIs, investment businesses, and SACCOs. It streamlines all workflow-related operations, manages accounting, clients, suppliers, and loan portfolios through financial planning, reports, and more. In this blog post, we will discuss the top 5 microfinance software and their prices. CoBIS Microfinance Software CoBIS Microfinance Software […]

-

10+ Top Microfinance Software Features

Microfinance software features are essential for the efficient management of microloans. These features include customer relationship management, loan origination and management, loan portfolio management, reporting and analytics, automated payment reminders, transaction history tracking, integrated account management tools, streamlined application process, automated credit scoring and risk assessment, efficient loan disbursement, repayment tracking, integration with mobile banking, […]